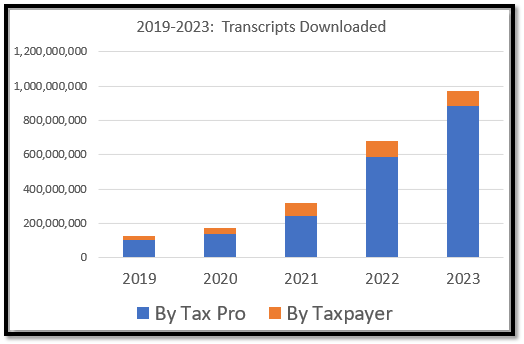

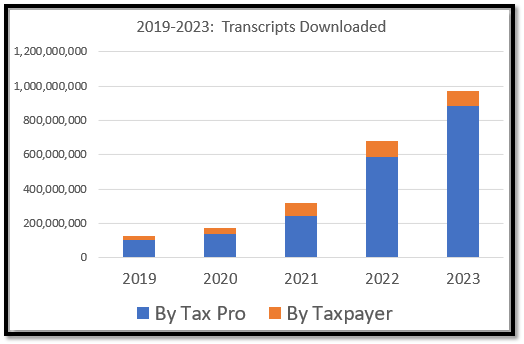

Using IRS transcripts (IRS speak for “tax records”) is becoming increasingly popular among taxpayers and tax pros. In 2023, tax professionals downloaded over 886 million taxpayer transcripts from the IRS – an 8.4X increase in the number of transcripts downloaded by tax pros since 2019. Taxpayers have also caught on, ordering over 83 million transcripts in 2023 – more than 3.5X more transcripts than they ordered in 2019.

Source: IRS Data Books 2022 and 2023, Table 25

Transcripts became more popular during the pandemic years, when taxpayers and tax pros had a very difficult time reaching the IRS for answers. Taxpayers experienced long wait times and at its low point, only 10% of taxpayers could reach the IRS to get answers. Many tax pros also started to realize that many of their answers were in their IRS transcripts. For example, pandemic related stimulus payments (recovery rebate, advanced child tax credit payments) could all be found by reviewing taxpayer IRS account transcripts. Those who used transcripts to quantify the stimulus amount paid could file more accurate returns and avoid return processing delays and refund changes. Those who did not use their account transcript contributed to the over 29 million math error notices issued to taxpayers in 2021 and 2022.

Tax pros realize that IRS transcripts contain a wealth of information and can be used in many ways. Many tax pros use transcripts to answer basic client IRS account information needs. However, over the past five years, more tax pros have been accessing and using IRS transcripts to keep track of their clients’ IRS status, and for IRS post-filing issue prevention, detection and resolution. Tax pros are starting to regularly use their clients’ IRS transcripts for:

- New client due diligence and tax history information

- Filing accurate back tax returns

- Confirming certain account actions, such as filing, payments, refund issued, extensions, etc.

- Filing an accurate amended return

- Evaluating penalty abatement relief

- Avoiding CP2000 income matching notices

- Detecting tax identity theft issues

- Preparing for an IRS audit

- Confirming that the client is in “good standing” with the IRS

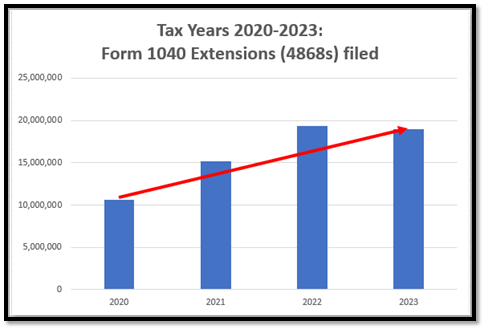

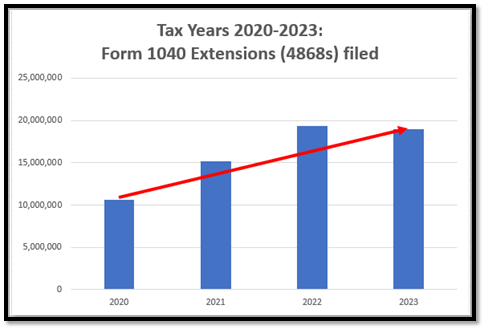

Tax pros have also been starting to realize that IRS transcripts can help with another growing client action: filing accurate extended returns. IRS data shows that almost 12% of Form 1040 taxpayers are now extending their time to file past the initial April deadline. In the 2023 tax season, over 19.4 million of the 162 million Form 1040 filers (12%) requested an extension of time to file until Oct. 15. This is true again for the 2024 tax season. Approximately 19 million individual taxpayers requested an extension to file their 2023 Form 1040 to the Oct. 15 extended filing date.

Sources for graph: IRS Publication 6292 for years 2020-2022, IRS Filing Season Data for 2023 returns and announcement IR-2024-109, April 15, 2024

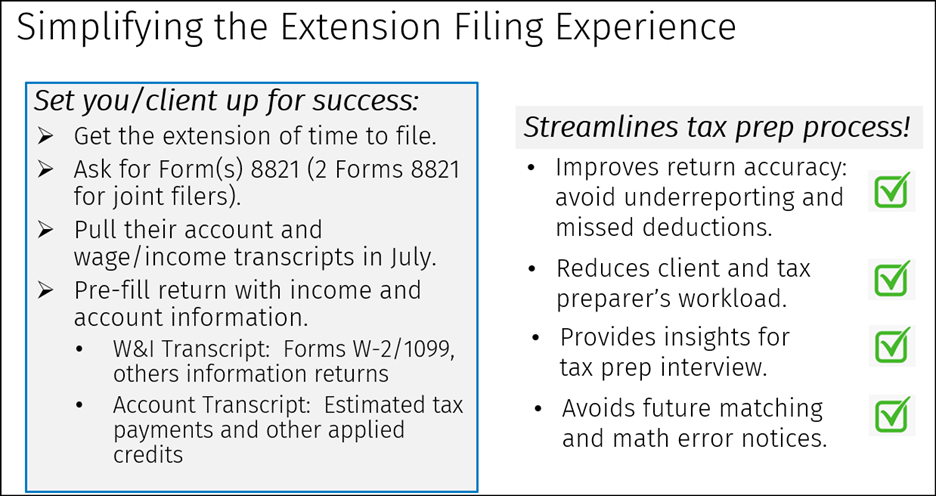

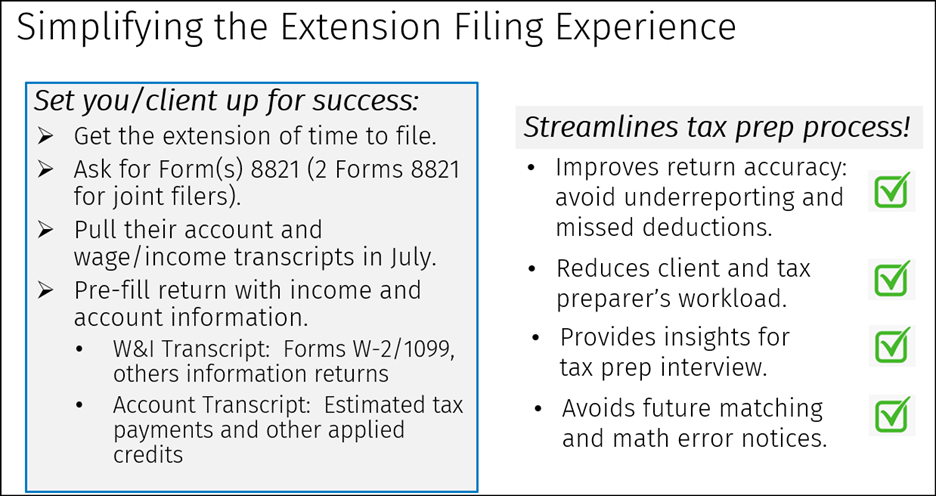

IRS transcripts, when used timely and correctly, can help a tax pro stage the post-April 15 filing experience. The transcripts provide the tax preparer a head start by identifying income, deductions, payments and other items that need to be reported on the return. Using transcripts can also help improve the accuracy of the return and avoid dreaded post-filing actions like audits and CP2000 matching notices.

Overview of IRS transcripts

Taxpayer account information is found in their IRS transcripts. There are three primary IRS transcripts:

Account: The account transcript provides details of each tax year and form with the IRS. Some important items include account information (filing status, dependents, AGI, tax, processing dates, etc.), account actions (payments, extensions, stimulus received, etc.), and other post-filing activities (audit and CP2000 indicators, IRS collection actions, penalties and other IRS and taxpayer activity). Generally, account transcripts are available online to taxpayers for the past five years. However, authorized tax pros can access account transcripts for many years prior to the current year.

Tax return: This transcript is an electronic copy of the original tax return processed for a taxpayer in the previous three processing years. Currently, taxpayers can normally obtain their 2020-2023 return transcripts. It contains most of the line items on the filed return.

Wage and income transcripts: This transcript contains a listing of all information returns filed under the taxpayer’s identification number. These include Forms W-2, 1099, 1098 and many others. This transcript is available for the past year at the end of May. The wage and income transcripts for the 2023 tax year became available to taxpayers on May 28, 2024. Currently, the IRS can provide the current year (2023), plus the prior nine years (2014-2022) of wage and income transcripts.

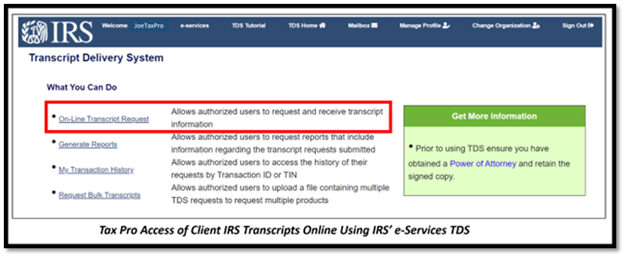

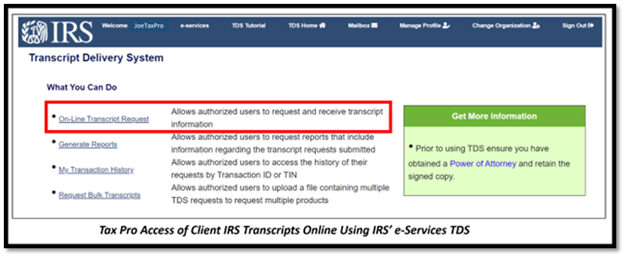

Taxpayers can get access to a limited number of their transcripts through the IRS “Get Transcript” application or in their IRS online account. All transcripts provided to taxpayers will have the personal identification information redacted. Tax pros can request unmasked wage and income transcripts from IRS’ Practitioner Priority Service (PPS) or download them directly if they have access to the IRS’ e-Services Transcript Delivery System (TDS).

How tax pros can get access to client transcripts

Tax pros can be authorized to get their clients’ transcripts via Form 2848, Power of Attorney, or Form 8821, Tax Information Authorization. To obtain the transcripts immediately, tax pros will also need to have an IRS e-Services account. There are two primary methods for tax pros to acquire client IRS transcripts:

Contact the IRS’ Practitioner Priority Service (PPS) hotline: An authorized tax pro can call the IRS PPS and the representative can place the transcripts in the tax pro’s e-Services mailbox (IRS calls the mailbox the “Secure Object Repository” or “SOR”). Tax pros can go to their SOR and download the transcripts.

IRS’ e-Services Transcript Delivery System (“TDS”): Tax pros can electronically download transcripts online if their authorization is on file with the IRS’ Centralized Authorization File (CAF) and they have access to the IRS’ TDS. When Form 2848 or 8821 is recorded with the IRS, the tax pro can access their e-Services account and download the transcripts via TDS.

There are several software programs that will automate both the download and analysis of IRS transcripts for the tax pro. These software programs are called “Intermediate Service Providers” and allow access to the tax pro’s SOR and TDS for transcript downloads. NATP partners with the most prominent ISP software, Tax Help Software, which can be used for transcript automation.

How to use transcripts for extension filers

Timely acquired IRS transcripts can provide the tax preparer with a streamlined head start to file an accurate tax return before October deadline. Here is how it works:

1. Obtain Form 8821, Tax Information Authorization, from the client

The Form 8821 allows the designee (the tax pro or tax firm) to acquire the IRS transcripts. If the authorization uses a tax firm (for example, ABC Tax Firm, Inc.) as the designee, the firm must have one of its employees contact the IRS PPS to acquire the transcripts. I recommend using an individual designee (a tax pro in the firm who owns the client relationship and has access to IRS’ TDS).

The firm and the individual designee can obtain a signed Form 8821 (one each for married filing jointly) at the time of the extension or afterward. If the tax pro has a business relationship with the client, the client can e-sign the Form 8821.

Note: I do not recommend using Form 2848, Power of Attorney. The POA form is for representation purposes. The Form 8821 is used for information gathering, such as obtaining IRS transcripts.

2. File the Form 8821 with the IRS

Send the Form 8821 to the IRS by fax or by using the IRS’ “Submit Form 2848/8821 Online” tool. If the client e-signed the Form 8821, the form must be submitted to IRS CAF via the “Submit Form 2848/8821 Online” tool to register the authorization.

In normal operations, the IRS will take 3-5 business days to record the Form 8821 to allow the individual designee access to transcripts via their IRS e-Services TDS

3. Obtain transcripts on current year

IRS wage and income transcripts are released each year at the end of May. However, in recent years, the May release has not had all the information returns on the transcript. I recommend that you wait until mid-July to obtain a full listing.

In mid-July, the designee(s) can call PPS or any individual designees can use their IRS e-Services TDS to obtain the transcripts. The current year wage and income transcript (both primary and spouse if filing jointly) and the account transcript are needed. These transcripts can be used to “pre-fill” the income, some deductions, payments and other items on the return, and to ask informed questions about the client’s tax situation.

4. Stage the return

Using the wage and income transcripts, the tax preparer can pre-fill the return with items reported to the IRS. If the client has a state filing obligation, they will need to provide the original W-2s, 1099-Rs, and other documents that could have state income tax withholding as IRS wage and income transcripts do not have this information. IRS wage and income transcripts also do not have the Form 1095 series for health care coverage and advanced premium tax credit payments. With the information returns, the tax preparer can refine the tax preparation interview by asking specific questions. The preparer may also discover information returns that the taxpayer may not have provided and avoid any CP2000 matching notice issues in the future.

The tax pro should also confirm that the IRS has processed their extension of time to file by reviewing the current year account transcript. The account transcript can also be used to verify the client’s estimated tax payments, refund credits from a prior year, and any other issues visible on the account.

5. Complete the tax return from an informed position

The tax preparer will still interview and obtain relevant information from the client to complete the return. Additional information not found in the transcripts, such as current year filing status, dependents, income not reported to the IRS, deductions and other important items, are added to file an accurate return. The preparer can use the taxpayer’s original Forms W-2 and other withholding evidence to confirm state withholding. The preparer may identify items that the client missed in their document gathering, such as stock sales reported on Form 1099-B.

A CP2000 matching notice can be avoided when the tax pro confirms all the items reported to the IRS on the return.

6. File and monitor

Unless revoked or withdrawn, Form 8821 allows continuous access to client transcripts for seven years after the signature date on the form. The designee(s) can access the client’s account transcript to confirm the return is filed and resulting actions (refund, payment, etc.) have been completed. The firm can periodically review the account transcript to identify any post-filing actions from the IRS, such as selection for audit.

Using IRS transcripts to stage and streamline the filing process for an extension filer puts the tax pro in an informed position and reduces the likelihood of the IRS challenging the return through CP2000, math error and refund hold notices. It also provides for a more efficient and effective tax pro and client experience.

Staging the filing process for extension filers is just one of the many uses for IRS transcripts. Continuous access to your clients’ IRS transcripts allows you to be informed all year long and reduces surprises when post-filing activities occur.