If you’re a practicing tax professional in the state of California who does not have a certified public accountant (CPA) or enrolled agent (EA) designation, you’re required to register by law as a tax preparer with the California Tax Education Council (CTEC).

Registration with the CTEC means the tax professional is a CTEC registered tax preparer (CRTP), and therefore must complete a few requirements upon registration, as well as when renewing registration.

Requirements were updated in 2020 and apply to those seeking CTEC registration in 2021.

CTEC requirements

As of July 1, 2020, all new applicants who would like to register as a tax preparer with CTEC must pass a criminal background check and submit fingerprint images to CTEC to determine an individual’s eligibility to register. These new requirements are not applicable to current CRTPs, only new applicants after July 1, 2020.

However, CRTPs who allow their CTEC registration to expire and re-register with CTEC after July 1, 2020, will be required to take the 60-hour qualifying education (QE) course, and will be required to go through a background check and submit fingerprint images to CTEC.

CRTPs who let their registration expire must complete the following before their application will be considered:

- Complete 60 hours (45 hours federal, 15 hours state) of QE with an approved CTEC education provider

- Obtain a $5,000 tax preparer surety bond

- Register for an IRS preparer identification number (PTIN)

- Complete a criminal background check and submit fingerprint images to CTEC

To renew a CRTP registration, you must:

- Complete 20 hours (10 hours federal tax law, 3 hours federal tax update, 2 hours of ethics and 5 hours of state tax law) of continuing tax education each year

- Maintain a valid PTIN

- Renew registration by Oct. 31 of each year

- Pay the registration renewal fee of $33

California preparers who do not meet these requirements are subject to a $2,500 fine for their first offense and $5,000 for every subsequent offense.

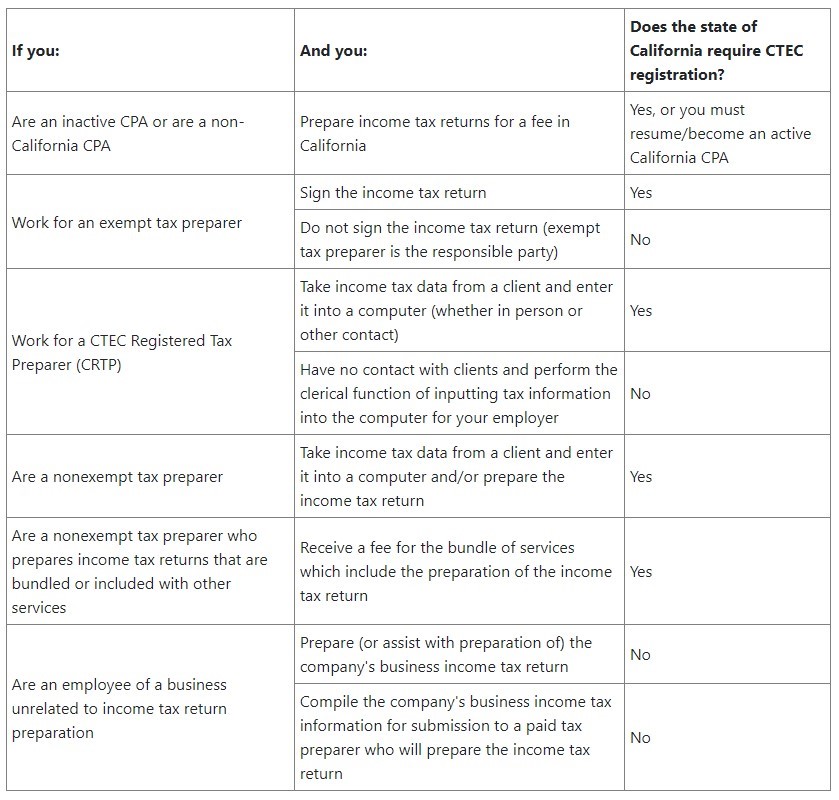

Who must register?

(Image source: ctec.org)

CTEC NATP members can take advantage of the free CPE with membership, including 4 CPE of ethics and due diligence webinars. You can also join the California NATP chapter for additional state-specific education and to network with other professionals in your area.

Information included in this article is accurate as of the publish date. This post is not reflective of tax law changes or IRS guidance that may have occurred after the date of publishing.