We were all put to the test in 2022 – more than ever before. Between stimulus payments and last-minute IRS guidance, coupled with the struggle of outdated and inaccurate correspondences, tax preparers endured a rough season.

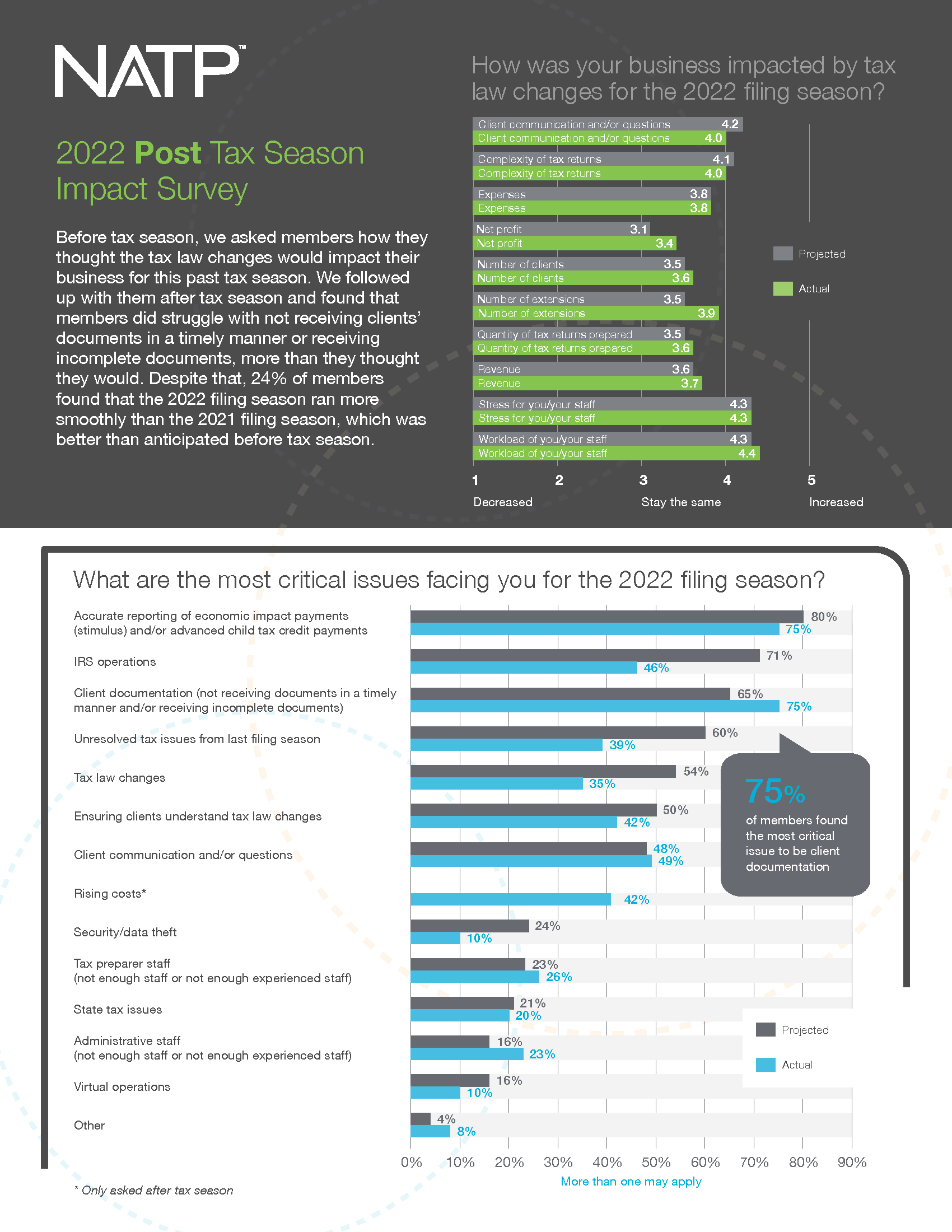

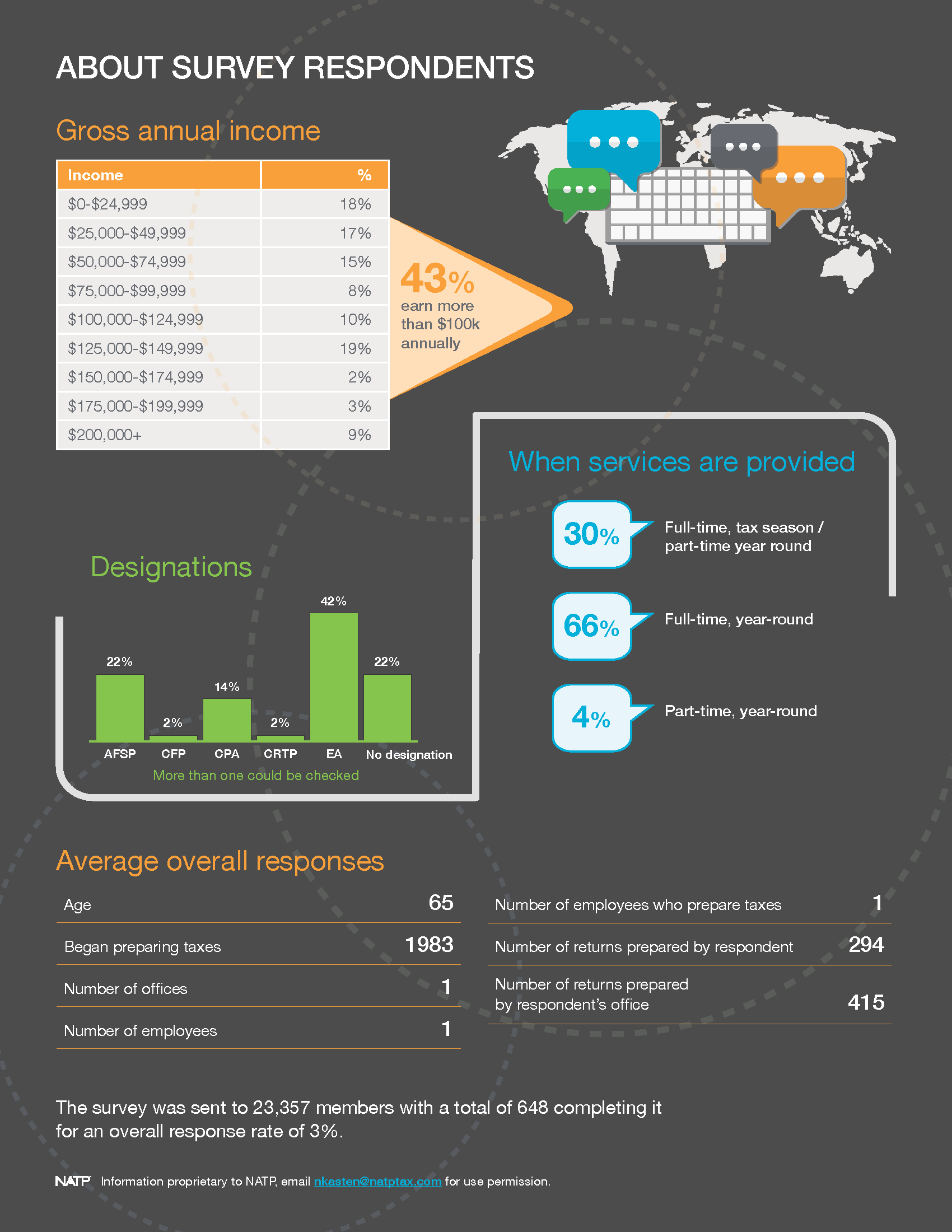

Before the 2022 season, NATP asked our more than 23,000 members what they thought their top challenges would be for the upcoming tax season. After the April 18 tax deadline, we once again asked them the same questions and found the biggest struggle (even more than anticipated) was receiving incomplete documents from their clients.

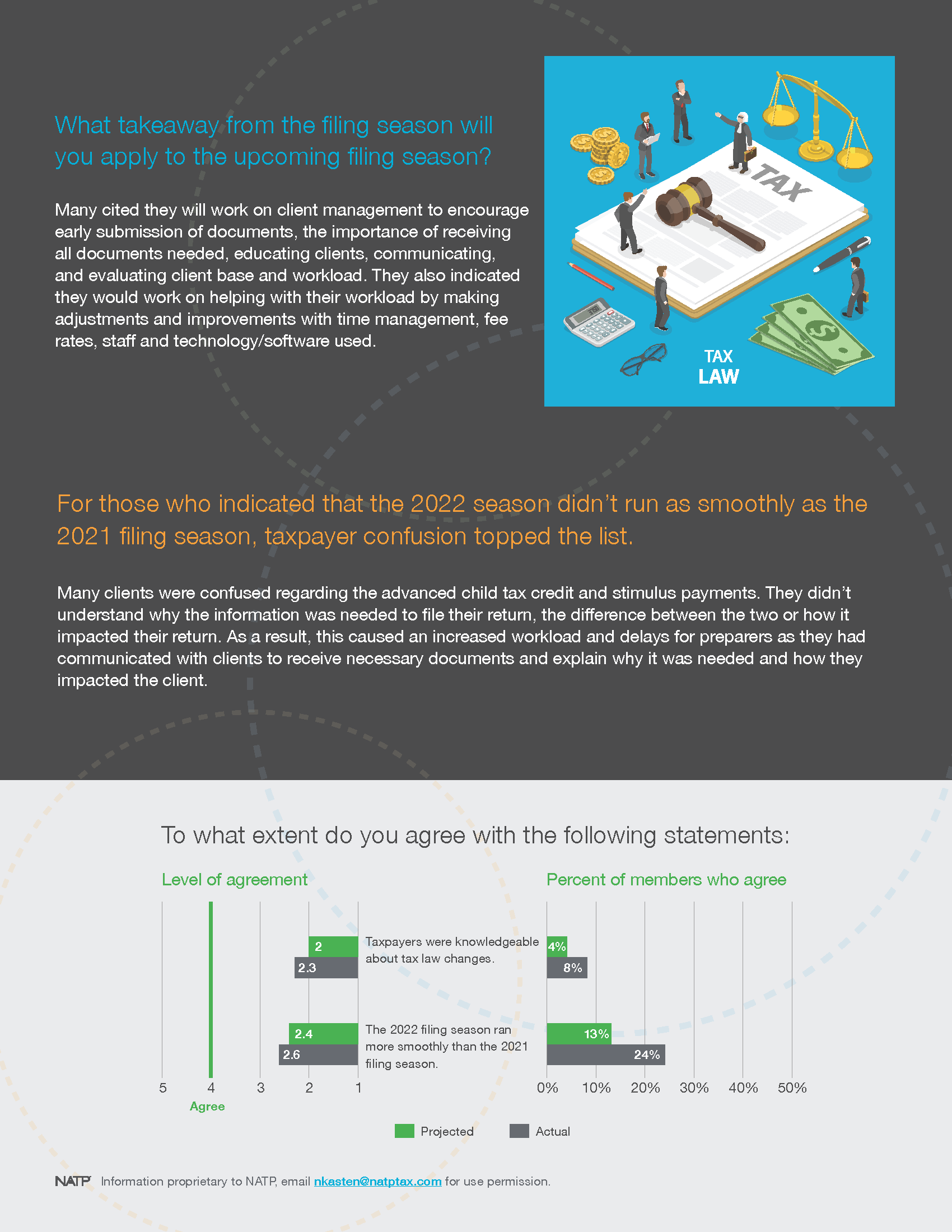

Despite that, 24% of members found the 2022 filing season ran more smoothly than the 2021 season, which was better than anticipated before tax season. Here are a few other findings:

According to the respondents, the most critical issues they faced for the 2022 filing season were inaccurate reporting of economic payments and advanced child tax credit payments, not receiving client documents in a timely manner, incomplete documents and less effective client communications.

Before tax season, only 13% of respondents thought this year would be better than tax season 2021. As it turned out, the post-season survey found that 24% of members felt the 2022 filing season ran more smoothly than the 2021 season.

While members thought IRS operations would be an issue before tax season began, the post-season survey showed that only 46% felt this way after the season compared to 71% of the respondents in February.

Respondents plan to combat the 2022 challenges next season by focusing on client management and encouraging the early submission of documents. Members also said they plan to stress the importance of receiving ALL documents needed, educating clients, and evaluating client base and workload.

For more on this topic, NATP and Drake Software hosted a post-tax season debrief roundtable discussion tax preparers can watch for free. To speak with someone further about the results email Nancy Kasten, NATP’s director of marketing, communications and business development.

Information included in this article is accurate as of the publish date. This post is not reflective of tax law changes or IRS guidance that may have occurred after the date of publishing.