Medicaid waiver payments – what are they and how do individuals report?

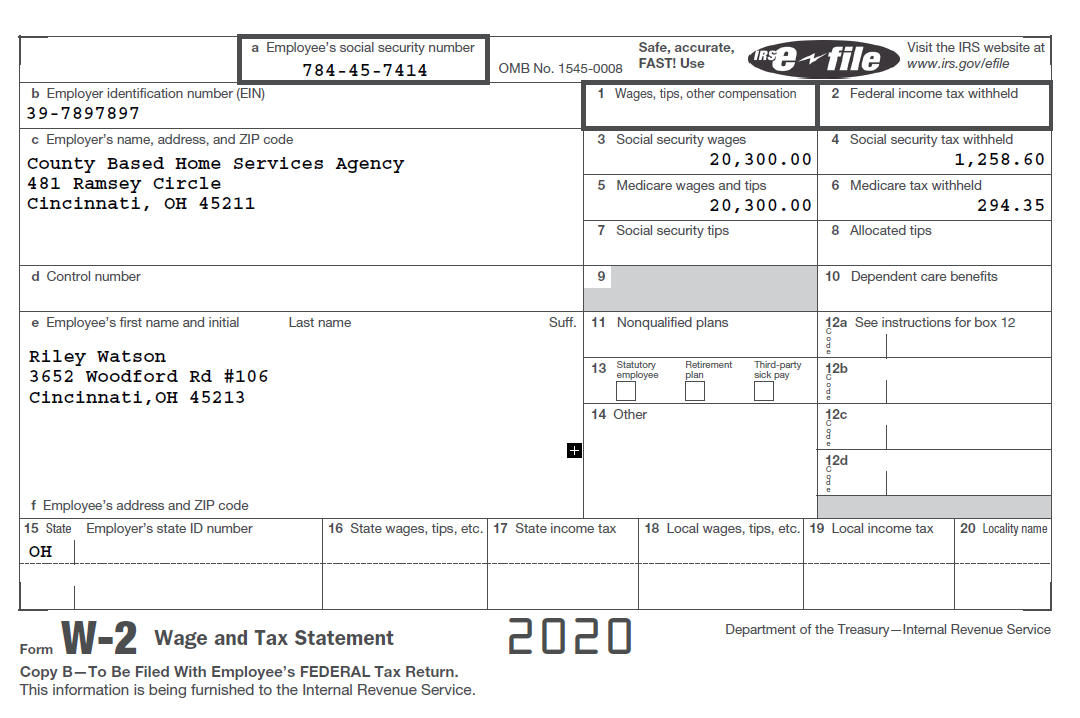

As practitioners, we receive many tax forms from our clients. Some of these forms we are very familiar with – Forms W-2, 1099-MISC, 1099-NEC to name a few. Many of us know what a correctly completed Form W-2, Wage and Tax Statement, should look like. If a client were to present the following hypothetical W-2 to you, would you think there is an error on the form?

Some of you may be thinking, yes there is an error because there are no federal wages or federal withholding. However, if the payments received by Riley are considered Medicaid waiver payments, the W-2 is prepared correctly and there would be no federal wages or federal withholding.

Many of us have never heard of Medicaid wavier payments and only become aware of the term when a client presents a W-2 similar to the one above. We will provide a high-level discussion of Medicaid waiver payments later in this blog, but for now, we will focus on the W-2.

The IRS provides questions and answers on Medicaid waiver payments. Per question 17, any amount an agency pays to an employee that is excludable from gross income shouldn’t be included in Box 1 (Wages, Tips, Other Compensation) of the employee’s Form W-2. If the entire amount the agency pays to the employee during the year is excludable from their gross income, Box 1 of Form W-2 should be left blank.

Payments made to employees generally are wages for Social Security and Medicare (FICA) tax purposes, even if the payments are excludable from gross income for income tax purposes. So, generally, the agency should withhold and pay FICA tax, and report the FICA wages and taxes withheld on the employee’s Form W-2 (Q 18).

What is a qualified Medicaid waiver payment?

Qualified Medicaid waiver payments are payments made by a state or political subdivision thereof, or an entity that is a certified Medicaid provider, under a Medicaid wavier program to an individual care provider for nonmedical support services provided under a plan of care to an eligible individual (related or unrelated) living in the individual care provider’s home.

Difficulty of care payments are payments representing compensation to a foster care provider for the additional care required because the qualified foster individual has a physical, mental or emotional handicap. The provider must provide the care in the provider’s foster family home, a state must determine the need for this compensation and the payor must designate the compensation for this purpose.

As of Jan. 3, 2014, the IRS announced it will treat qualified Medicaid waiver payments as excludable difficulty of care payments, regardless of whether the care provider is related to the eligible individual.

Notice 2014-7 addresses the exclusion from income for Medicaid waiver payments. The notice does not change the treatment of the payments as earned income for tax credit purposes. These payments remain earned income for purposes of the earned income credit and the additional child tax credit.

Feigh vs. Commissioner

Feigh v. Commissioner concluded that Medicaid waiver payments were earned income. This means, in the context of a W-2 person and the earned income credit (EIC), earned income is compensation received as an employee (for example wages), but only if the amount is included in gross income for the tax year. Medicaid waiver payments that may be excluded from income under Notice 2014-7 may still be treated as earned income for purposes of the EIC. A discussion of Feigh vs. Commissioner and earlier treatment of Medicaid waiver payments can be found in the TAXPRO Monthly, Issue 9, Volume 41, September 2019 issue.

As a side note, for 2020, the EIC is claimed on Line 27 of Form 1040. Schedule EIC must be filed if the taxpayer has a qualifying child. Worksheets are provided by the IRS and in most cases by your software.

Non-deductible IRA contributions

An issue many foster care providers have experienced prior to COVID is the inability to contribute to an IRA. The payments received were not considered taxable income and therefore the taxpayer was not eligible to make an IRA contribution unless they had compensation from other sources. The Setting Every Community Up for Retirement Enhancement (SECURE) Act changed that.

Under the SECURE Act, difficulty of care payments may increase the amount of nondeductible IRA contributions, but not above the annual statutory limit.

Tax return presentation

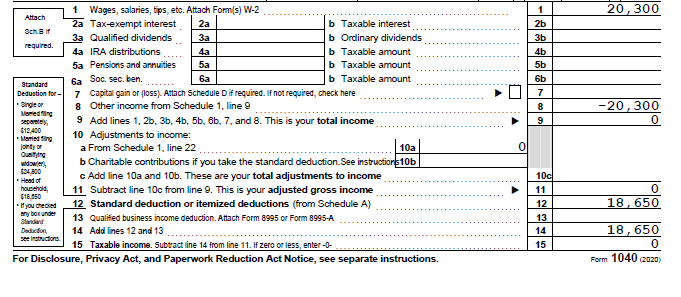

Many of you are wondering how all of this gets presented on the taxpayer’s tax return. Here’s an example to help illustrate:

Riley Watson, age 26, is a single mom receiving $20,300 in Medicaid waiver payments in 2020 to care for her disabled son Caden. Caden is 5 years old, and the payments are Riley’s only source of income. Her W-2 was prepared as presented above.

Per the Form 1040 instructions, Line 1 includes “any Medicaid waiver payments you received that you choose to include in earned income for purposes of claiming a credit or other tax benefit, even if you didn’t receive a Form W-2 reporting these payments.”

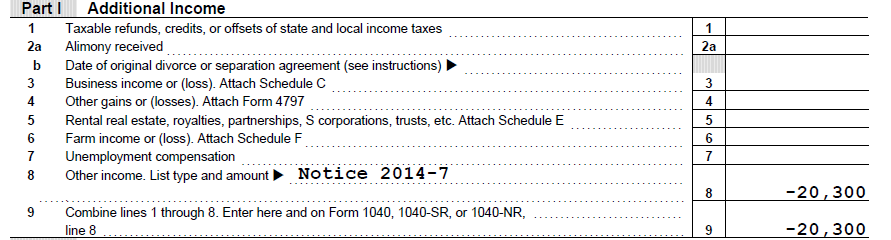

Schedule 1, Line 8 instructions, tell us to:

- Include on Line 1 any Medicaid waiver payments you received that you choose to include in earned income for purposes of claiming a credit or other tax benefit, even if you did not receive a Form W-2 reporting these payments.

- On Line 8, subtract the nontaxable amount of the payments from any income on Line 8 and enter the result. If the result is less than zero, enter it in parentheses. Enter “Notice 2014-7” and the nontaxable amount on the dotted line next to Line 8.

The instructions are similar to what the IRS is saying in Q 9. Taxpayers who receive payments described in Notice 2014-7 that are treated as difficulty of care payments can choose to include the payments in earned income for purposes of the earned income credit (EIC) or additional child tax credit (ACTC). This Q and A was updated May 8, 2020, and indicates, while earned income for EIC or ACTC, the payments are not taxable for federal income tax.

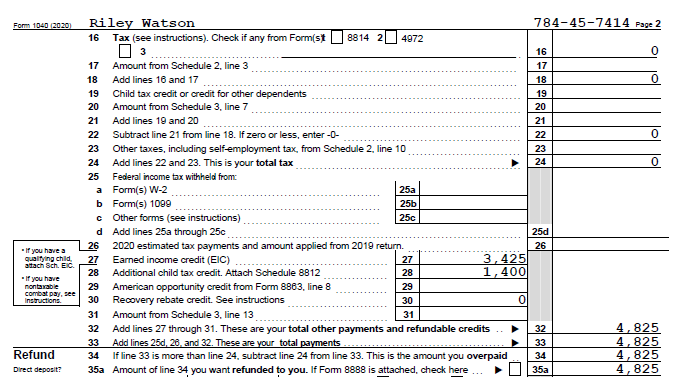

Example:

In this scenario, Riley included as wages on Line 1 the non-taxable income, backed it out on Schedule 1, Line 8. Despite having no taxable income or tax liability, she is eligible for a $3,425 EIC and $1,400 additional child tax credit. The EIC amount can be calculated by using the EIC table provided in the instructions. Schedule 8812, Additional Child Tax Credit, would be used to calculate the ACTC.

Riley could also contribute to a nondeductible IRA if she wanted to.

The American Rescue Plan Act of 2021 (ARP) signed on March 11, 2021, made changes to the child tax credit (CTC). As we see in the above example, under the CTC in effect for tax year 2020, only up to $1,400 of the CTC was refundable (and this could only be obtained if the taxpayer has earned income of at least $2,500).

Some have seen this as burdensome for lower-income individuals who most likely need the CTC benefit the most. Under the ARP Act, changes have been made to the CTC for 2021. For tax year 2021, the credit is fully refundable (the $1,400 refundable limit has been removed) and the $2,500 earned income requirement has been eliminated.

To learn more about the tax impacts of having a child, you can attend NATP’s self-study – free for Premium level members!