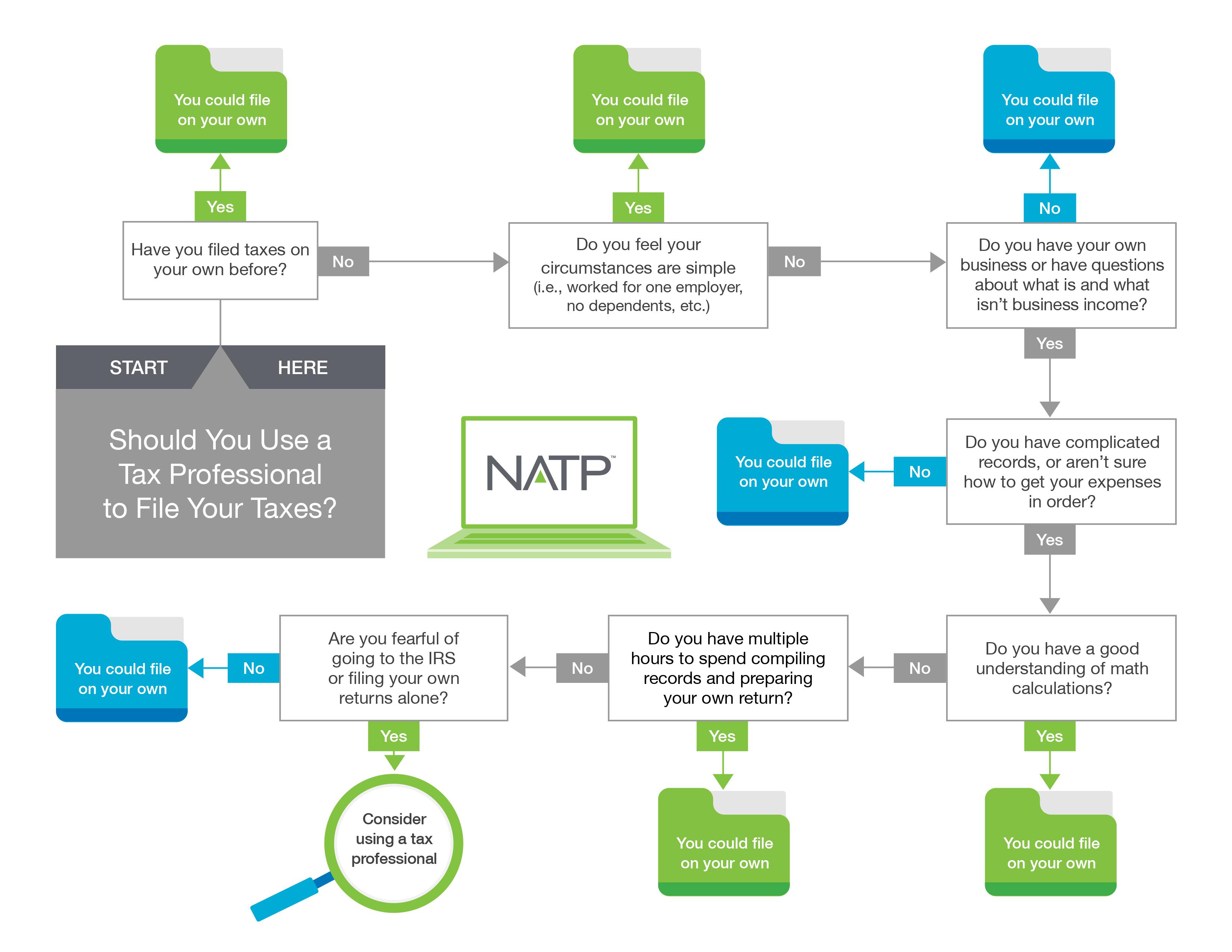

While all taxpayers could benefit from the help of a knowledgeable, qualified tax professional, some taxpayers have a simple enough tax situation where they could file on their own if they feel comfortable doing so.

Here’s a handy flowchart to help you determine if you should consider taking on the task of preparing and filing your taxes on your own. However, if you have any questions or issues as you’re preparing your returns this tax season, NATP (the National Association of Tax Professionals) has a tool to help you find a preparer near you.

Information included in this article is accurate as of the publish date. This post is not reflective of tax law changes or IRS guidance that may have occurred after the date of publishing.