The IRS has released its data book for the 2023 fiscal year to provide information on returns filed, taxes collected, refunds issued, enforcement, the agency’s workforce and other activities. The IRS’s 2023 fiscal year ran from Oct. 1, 2022, through Sept. 30, 2023, and the data book provides 35 statistical tables breaking down various aspects of its operations. Highlights from the book are included below.

Returns filed, taxes collected and refunds issued

The data book provided a broad overview of the IRS’s two main functions: processing federal tax returns and collecting revenue. The data included the following information on the IRS’s activities:

- Processed more than 271 million returns and supplemental documents during FY 2023, a 3.3% increase from the nearly 263 million filed during FY 2022

- Collected nearly $4.7 trillion in gross taxes for FY 2023, down from $4.9 trillion for FY 2022

- Issued 125.5 million refunds for FY 2023, totaling roughly $659.1 billion

How taxpayers filed

The IRS data also offered information on how taxpayers chose to file their returns during FY 2023:

- 84 million individual tax returns were electronically filed by paid preparers

- 90.7% of individual taxpayers filed electronically

- 2.9 million returns were filed using the IRS Free File program

- 213.3 million returns and other forms were filed electronically, which was roughly 78.6% of all filings

IRS compliance activities

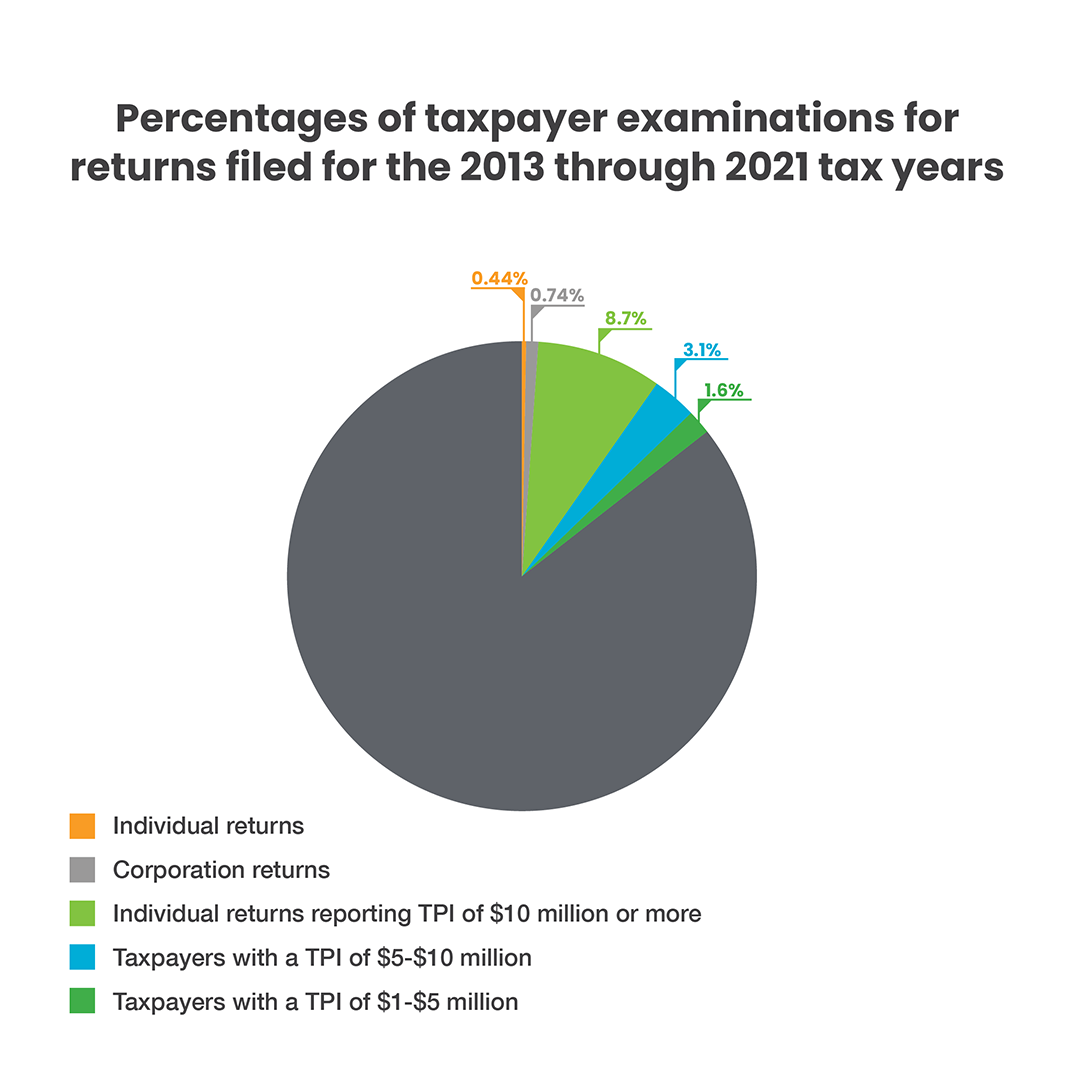

The IRS examined 0.44% of individual returns filed during the 2013 through 2021 tax years and 0.74% of corporate returns. However, higher income individuals were examined more often with 8.7% of individuals reporting total positive income (TPI) of at least $10 million being examined from 2013 through 2021. For individuals with TPI of $5 to $10 million, the examination rate was 3.1% and it was 1.6% for individuals with a TPI of $1 to $5 million.

The agency offered the following information on audits closed during FY 2023:

- 582,944 tax return audits were closed, resulting in $31.9 billion in additional tax recommended

- 16,302 examinations resulted in refunds totaling $4.8 billion, with $2.7 billion going to corporations

- 22.7% of exams were conducted in the field and resulted in recommendations for $21.4 billion in additional tax and assessments

- 77.3% of exams were conducted through correspondence and resulted in $7.8 billion in additional tax and assessment recommendations

- 1 million cases were closed under the Automated Underreporter program, resulting in $6.6 billion in additional assessments

Net tax collections by type

The IRS provided a breakdown of the just over $4 trillion of net taxes (collections minus refunds) collected during FY 2023 by type:

- Business income taxes: $413 billion, which was 10.2% of total net collections

- Individual, estate and trust income taxes: $2.01 trillion, or 51.9% of the total

- Employment taxes: $1.42 trillion, which was 35.2% of the total

- Estate and gift taxes: $33.6 billion, or 0.8% of the total

- Excise taxes: $72.1 billion, which was 1.8% of the total

Information included in this article is accurate as of the publish date. This post is not reflective of tax law changes or IRS guidance that may have occurred after the date of publishing.