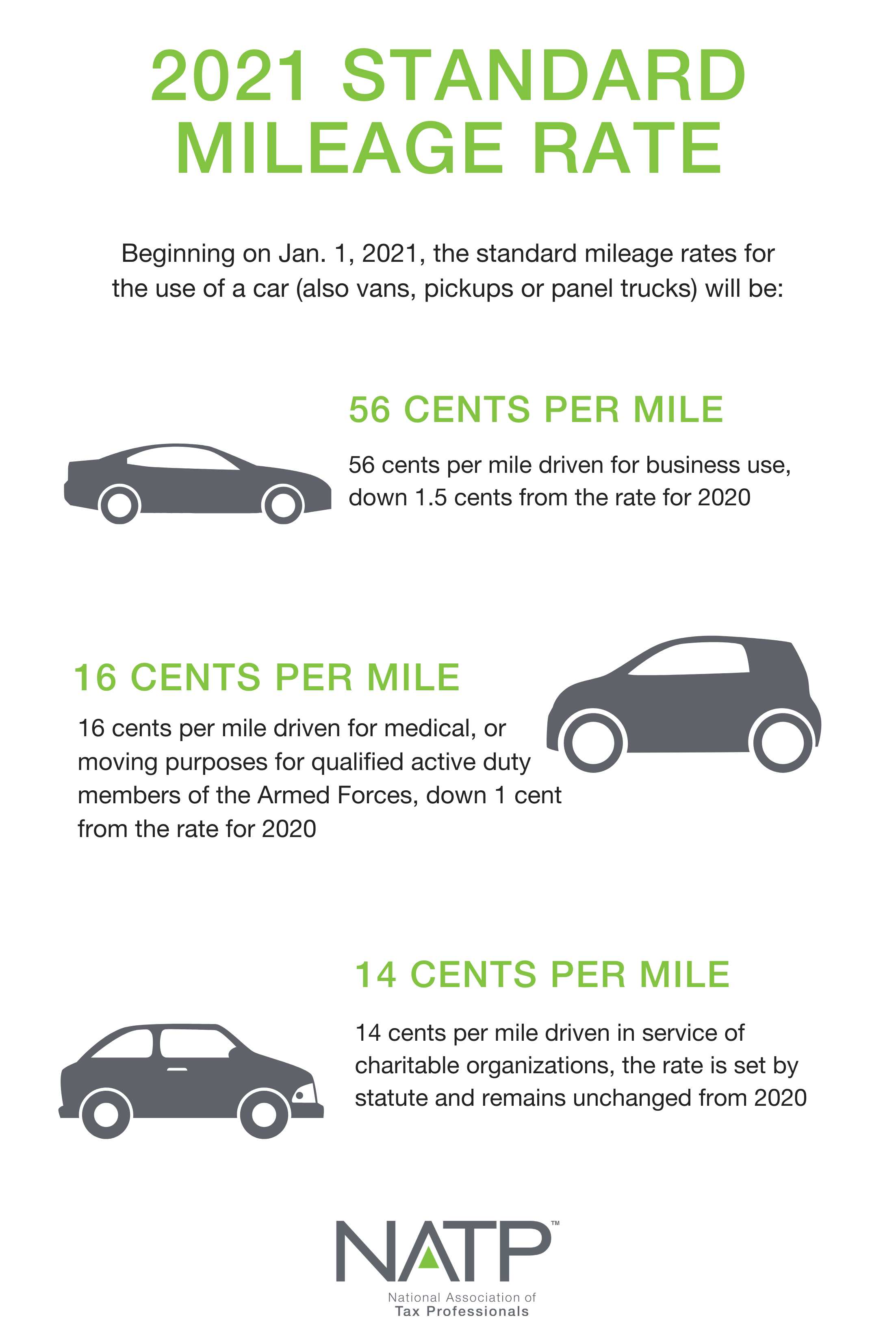

2021 standard mileage rates

Beginning Jan. 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

- 56 cents per mile driven for business use, down 1.5 cents from the rate for 2020

- 16 cents per mile driven for medical, or moving purposes for qualified active duty members of the Armed Forces, down 1 cent from the rate for 2020

- 14 cents per mile driven in service of charitable organizations, the rate is set by statute and remains unchanged from 2020

The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. The rate for medical and moving purposes is based on the variable costs.

It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Taxpayers also cannot claim a deduction for moving expenses, unless they are members of the Armed Forces on active duty moving under orders to a permanent change of station.

Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.