With the holiday season right around the corner, have you ever wondered what the tax return would look like for Santa Claus? Here at NATP, we are tax geeks at heart and we’ve long been curious. What’s his income? What is Santa’s ordinary and necessary business expenses? Let’s break down the tax issues Santa may face and have a sneak peek at what his return might look like.

Santa’s marital status seems clear; he’s married to Mrs. Claus. Thus, his likely filing status would be married filing jointly. This would give him a higher standard deduction and favorable tax brackets.

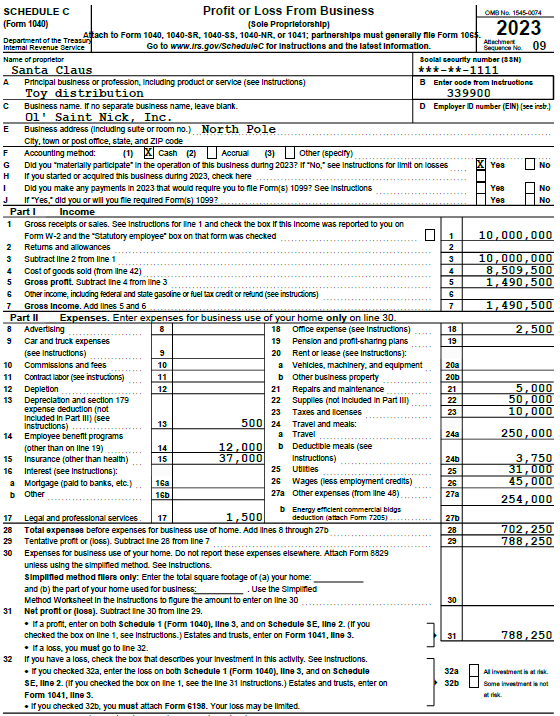

Santa’s primary “business” is delivering toys worldwide, which makes him a potential sole proprietor — or possibly the head of a multinational conglomerate. If he is self-employed, he would file a Schedule C, unless he selects to have his business taxed as another type of entity. The pros and cons of his choice of how his business is taxed would require a deeper dive into how Santa runs his workshop than we are undertaking here.

Once you start thinking of what Santa’s return would look like, there is major a hurdle to clear: What is his income? He doesn’t charge for his services. Could one argue that the milk and cookies left for him are bartering income? On the flip side, are these gifts? These are all questions that need to be asked in what seems like a simple task of preparing a return for Santa.

That said, Santa might also generate income from intellectual property. The use of his likeness and image in various advertising campaigns could result in royalty income, which would be included on Schedule E of his return.

Santa’s business comes with substantial operational expenses, which are tax-deductible. Here are some notable deductions he’d likely claim:

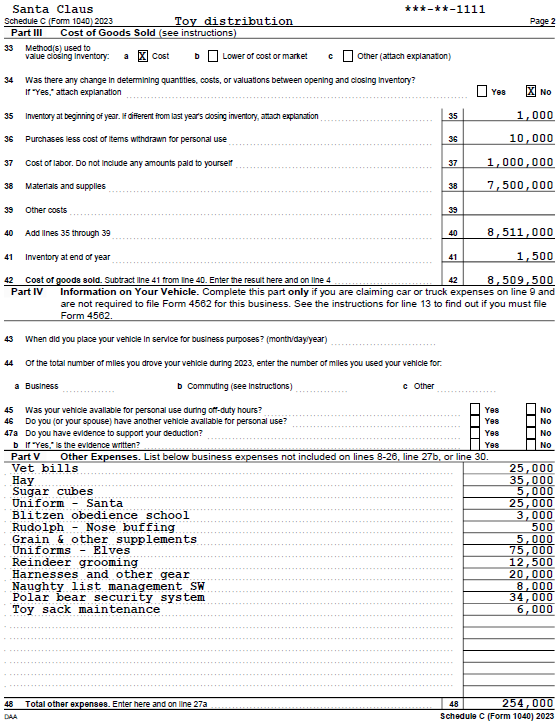

- Labor costs: The salaries and benefits for his team of elves would be deductible as ordinary and necessary business expenses. If Mrs. Clause helps out with in the workshop, she might also be on the payroll.

- Sleigh maintenance: Keeping a magical sleigh in top condition isn’t cheap. Fuel (magic dust?), repairs and insurance would all be legitimate business expenses.

- Reindeer care: His reindeer team’s veterinary bills, food and training costs would also qualify as deductions. If they’re considered “working animals,” this expense would be fully deductible.

- Workshop utilities: The cost of maintaining a massive, year-round toy factory would include deductions for utilities, repairs and property taxes. One wonders if Santa could take advantage of energy-efficient credits for the North Pole.

- Travel expenses: Santa’s global travel in one night is no small feat. While he doesn’t seem to spend money on airline tickets, there may be deductions for magical fuel or tolls for passing through restricted airspace.

- Depreciation of assets: Santa’s sleigh and workshop are substantial capital assets. Depreciation rules would allow him to deduct their cost over several years. Since Santa has been in business for centuries the costs are fully depreciated. However, any repairs may still be on the books.

What would Santa’s Schedule C look like? Here is a quick peek at what his might of looked like for 2023 (of course, a lot of assumptions were made).

Between managing deductible expenses for reindeer, claiming potential royalty income and navigating international tax law, Santa’s tax return would make even the most seasoned tax professional reach for the eggnog.

Happy holidays and may your tax season be less complex than Santa’s!

Information included in this article is accurate as of the publish date. This post is not reflective of tax law changes or IRS guidance that may have occurred after the date of publishing.