Earning a designation is not just a huge personal accomplishment, it can help take your tax career to new heights, too. Depending on your professional goals, this could be the first step toward taking on new clients, working your way into new industries within tax or even teaching others how to do what you do. The first big question you need to answer after you decide to start the journey of earning a designation is, which designation is best for you and your professional goals?

NATP is hosting a free informational webinar designed to explain the difference between a couple of the most common designations tax pros choose: the EA (enrolled agent) or the Annual Filing Season Program (AFSP) – Record of Completion.

Upon completion of this course, you will be able to:

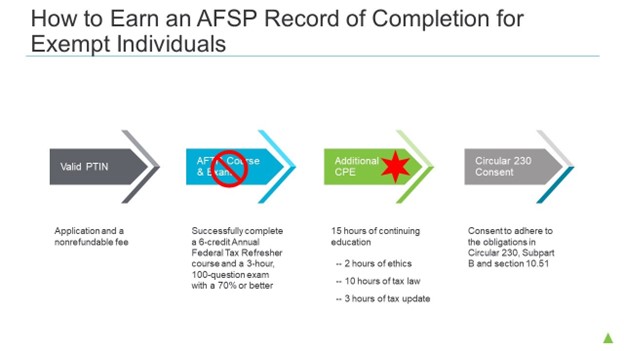

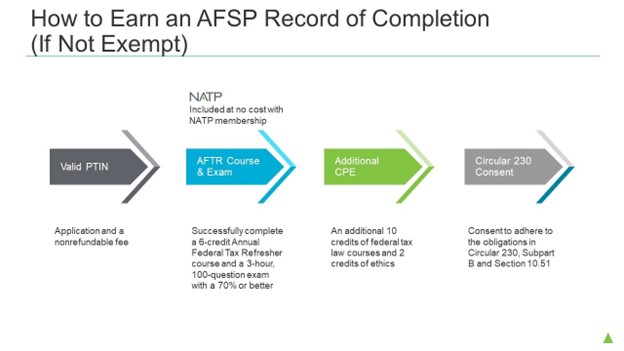

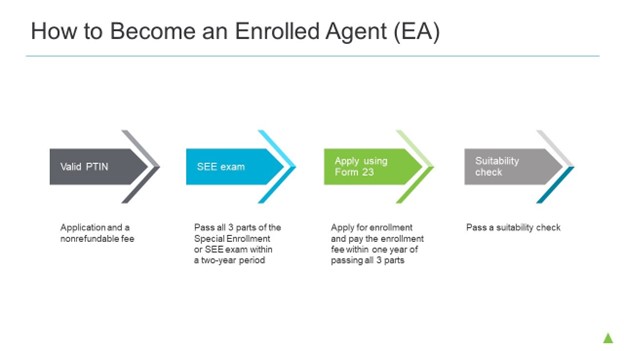

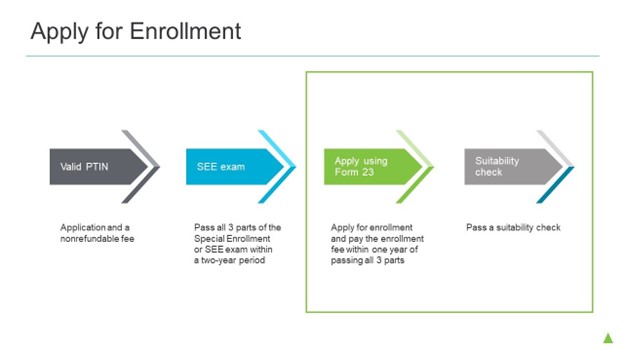

- Explore the unique roles and responsibilities of both an EA and AFSP record of completion holder

- Review the advantages of each designation and how they can bolster your professional credibility and expertise in tax preparation and representation

- Assess the impact of each on your career path

- Navigate through the ongoing annual requirements associated with maintaining each

- Learn how NATP can serve as your invaluable resource in kickstarting your journey towards obtaining either

Here’s a quick preview of what you can expect from this webinar, which will be held live June 5, 2024.

Information included in this article is accurate as of the publish date. This post is not reflective of tax law changes or IRS guidance that may have occurred after the date of publishing.