IRS collection and non-filer enforcement has been, for the most part, non-existent since the beginning of the COVID-19 pandemic in March 2020. During the pandemic, the IRS, like most of the world, pivoted to remote operations and helping with the pandemic. Most IRS personnel fully returned to their offices in June 2022 but were still under a moratorium for automated collection and non-filer notices. IRS collection and non-filer enforcement was left to the IRS’s limited field collection resources for only the most serious tax debtors and high-income non-filers.

On Dec. 19, 2023, the IRS announced that the moratorium on collection and non-filer enforcement is over. In January 2024, the IRS restarted its primary collection function, the Automated Collection System (“ACS”). Many taxpayers who owe tax for years before 2022 are now seeing IRS collection notice activity. They can face follow-up collection enforcement through liens, levies and passport restrictions if they do not pay or get into a collection agreement on their back balances owed.

The restart of automated notices on 2022 tax periods was already in effect when the IRS started these notices in October 2023. The Dec. 19 announcement means the IRS is back in full automated collection mode on tax debtors.

Collection notices

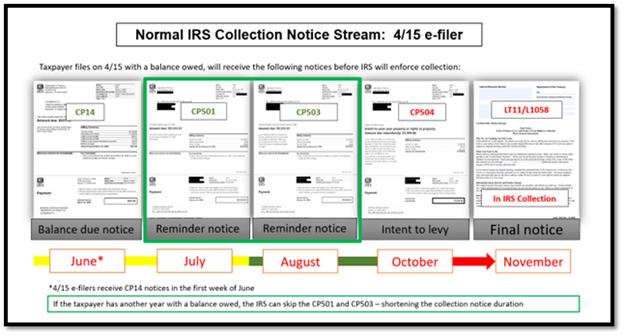

The IRS can collect through automated notices or local IRS enforcement resources (i.e., “revenue officers”). Traditionally, most of the IRS collection and non-filing notices, and enforcement, originate through its ACS. The ACS sends a progression of letters to taxpayers to collect on back tax debt balances, potentially ending in lien, levy and passport restriction notices if the taxpayer does not pay or enter into a collection agreement. The automated notices are called the IRS “collection notice stream.” In all, a taxpayer can get as many as five notices from the IRS before a levy/garnishment is issued. Without payment or a client collection agreement, the notice process and ultimate levy can take more than six months after the return is filed with a balance due assessment.

The initial notice is a demand for payment and is required by law to be issued within 60 days after the tax is assessed (CP14 notice, Balance Due). Taxpayers who file by the April 15 deadline receive this notice in the first week of June. Because this notice is required by law, the IRS continued to send them throughout the pandemic and IRS collection notice moratorium. In 2023, the IRS sent almost 12.2 million CP14s – a 30% increase from 2022 when the IRS sent 9.4 million CP14s to individual taxpayers.

If the taxpayer does not pay the bill or set up a collection agreement, the IRS will proceed with more notices with increasing urgency for the taxpayer to make arrangements on their tax bill. The first notice, the CP501 reminder notice, comes five weeks after the CP14, and the subsequent notices (a second CP503 reminder notice and CP504 final notice) come eight weeks in succession after CP501 notice. As part of the 2023 collection restart initiative, the IRS increased the time between the CP501, CP503 and CP504 notices from five weeks to eight weeks to provide taxpayers and their professionals more time to reach an agreement with the IRS. The CP501 and CP503 reminder notices are optional. The IRS may advance to the CP504 notice and skip the CP501 and CP503 if the taxpayer has prior non-compliance, such as multiple years of balances owed. The CP504 notice also allows the IRS to levy future state income tax refunds to satisfy the balance owed.

Ultimately, taxpayers who do not pay the IRS after the CP504 notice can enter the IRS collection enforcement phase. The restart of collection notices means many will go into the IRS ACS and be issued a 30-day warning letter (Letter LT11, Final Notice of Intent to Levy) to pay, get into an agreement, contest the liability owed or be subject to levy action.

In the past 4 years, the IRS had very little collection activity and notices via its ACS. In 2023, the IRS did not issue any follow up ACS notices:

| Collection Notice | Number of notices: fiscal year ending Sept. 30, 2023 |

|---|---|

| CP14: Balance due notices | 12.2 million |

| CP501: Reminder notice | 0 |

| CP503: Second reminder notice | 0 |

| CP504: Notice of intent to levy | 0 |

| LT11: Final notice of intent to levy | 0 |

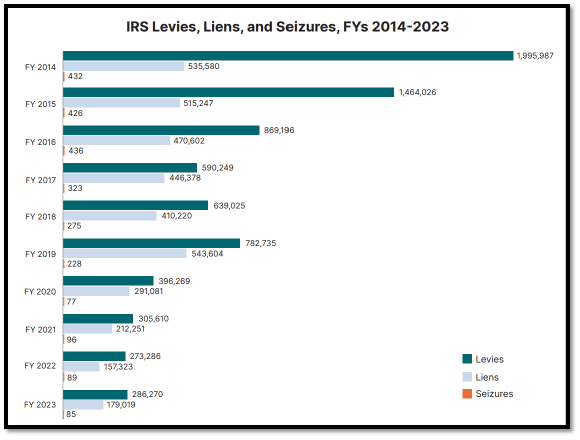

As a result, IRS collection enforcement activity dropped to an all-time low in 2020-2023. The Taxpayer Advocate charted the reduction in the number of liens, levies and seizures, which were especially low during the 2020-2023 pandemic years.

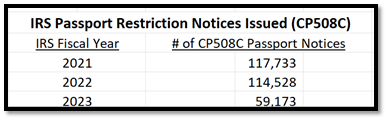

Passport restriction enforcement has been reduced also. Passport restrictions apply to those who owe more than $62,000 and are not in an agreement with the IRS on their balances owed. The IRS classifies these delinquent taxpayers as having serious delinquent tax debt (SDTD) and sends letter CP508C, SDTD Certification, to the taxpayer and to the State Department for potential passport restrictions. IRS passport restriction enforcement numbers will likely go up from its decline over the pandemic years:

IRS Notice LT38

The IRS is easing into its restart of automated collection. Many taxpayers have not received an IRS balance due notice in some time. To begin collection, the IRS will send taxpayers IRS letter LT38, Reminder - Notice Resumption, to those who owe for tax years 2021 and earlier, and are assigned to the Automated Collection System. LT38 notices were delivered to some individual and business taxpayers in the last week of January. The IRS will gradually increase the volume to more taxpayers throughout 2024. Taxpayers who do not pay or enter into an agreement will start to receive the collection notice stream from the IRS ACS five week after the LT38 notice.

With enforcement comes penalty relief

With enforcement returning, the IRS provided an incentive for taxpayers to pay. Form 1040, 1120 and 1041 filers who owe for 2020 and 2021 can qualify for failure to pay penalty relief if their tax bill for any year is under $100,000 (assessed tax only). The IRS will provide penalty failure to pay penalty relief only for the relief period between Feb. 5, 2022, and March 31, 2024. The taxpayer will have also had to receive their bill assessed before Dec. 7, 2023, to qualify. This provision will exclude all who have not filed and owe the IRS after that date. On April 1, 2024, the relief period is over and the failure to pay penalty resumes. This provides taxpayers an incentive to pay before April. Interest will still be owed on the balance (currently at 8%).

Next steps

There are currently over 20 million individual and 4 million business taxpayers who now owe the IRS back taxes, and the number of tax debtors has grown by almost 4 million since 2019.

However, many taxpayers are not in good standing with the IRS and face potential enforcement. As of Sept. 30, 2023, out of the 24 million individuals and businesses who owe, only 4.2 million or 17.5% of taxpayers are in an agreement on their back balances owed:

| Collection status | Number of taxpayers as of Sept. 30, 2023 |

|---|---|

| Total taxpayers in an IRS agreement as of 2022 | 4.2 million |

| In an IRS payment plan | 3.7 million |

| In “not collectible” status due to hardship | 461,569 |

| Received an offer in compromise | 13,165 |

| NOT in an IRS agreement (out of 24 million who owe IRS) | 19.8 million |

And the number of tax debtors continues to grow. At the end of summer 2023, 2022 balance due filers grew by almost 10% from the 2021 tax year filers. Many of these taxpayers, without IRS payment reminder notices, will be added to the rolls of those who owe the IRS and are not in an agreement to pay.

Tax professionals will be called upon to get taxpayers back in good standing with the IRS. The IRS will also resume enforcement of back tax year non-filers. Tax pros will need to get their clients back into good graces by filing back returns and/or resolving back balances owed through payment plans, extensions to pay or negotiating hardship agreements such as not collectible status or an offer in compromise settlement.

As IRS enforcement restarts, doing nothing is no longer an option if the taxpayer wants to avoid IRS enforcement through liens, levies and passport restrictions.

Information included in this article is accurate as of the publish date. This post is not reflective of tax law changes or IRS guidance that may have occurred after the date of publishing.