Change in accounting method

The need to change accounting methods can happen for a variety of reasons. Business conditions may change, making an accounting adjustment a better long-term tax strategy. An error in depreciating an asset may need to be corrected. As in the case of the Tax Cuts and Jobs Act (TCJA), Congress passed new tax laws that resulted in opportunities for you to put your clients in better positions.

If your client’s business has product inventory under $25 million, the TCJA allows these businesses to change from the accrual method to the cash method. You may need to sit down and run the numbers so you can analyze the results and present your client with the option of staying with the accrual method or changing to the cash method.

If you have a client for whom you cannot change the accounting method by amending the return, you can calculate the §481 adjustment. The §481 adjustment shows what the difference would have been had the new accounting method been previously selected. This adjustment is calculated by redetermining taxable income for the year of change and the two prior years, then summing the differences. If the §481 adjustment increases taxable income, the adjustment may be able to be spread over a four-year period. However, if the adjustment reduces taxable income, the entire adjustment is made for the tax year of the change.

Let’s look at a short example. You calculate the §481 adjustment to be an increase of $100,000 in taxable income. You can spread this over four years to reduce the impact on your client’s cash position, but the client will have to be able to pay the tax on the additional $25,000 in taxable income today. You can now discuss with your client the pros and cons of making a change in accounting method and the immediate impact they will face by making this change.

Once the decision has been made to change accounting methods, the next step is to determine how to make that change. There are two potential ways to change accounting methods: amending the tax return and filing Form 3115. While amending the tax return is the easiest option, this can only occur if there has only been one return filed using the old accounting method. If multiple returns have been filed, the accounting method is considered established and Form 3115 must be used.

If Form 3115 is being filed, there are two types of change procedures: automatic or non-automatic. The automatic change is the more favorable of these approaches and is required for qualifying organizations. As is indicated by the term “automatic,” this method virtually guarantees the method of accounting change request will be approved. The Form 3115 instructions include a list of designated automatic accounting method change numbers (DCN). DCNs are subject to change via revenue procedures and should be relied on to update DCN changes. Rev. Proc. 2019-43 contains the most recent DCN list. If a business is a qualified small taxpayer, in addition to qualifying as an automatic filer, they also qualify for a reduced Form 3115 filing requirement. For more information on who meets the small taxpayer qualifications, see the [Form 3115 instructions][1].

Non-automatic filers must first receive consent from the IRS national office before filing Form 3115. Even with advanced consent, there is no guarantee the IRS will grant final approval of the accounting method change. Anyone seeking to change their accounting method who does not qualify as an automatic filer must use the non-automatic filing procedure. Non-automatic filers are also subject to a user fee of up to $10,000. (Rev Proc 2019-1, Appendix A.)

The table below offers a quick comparison of the automatic and non-automatic filing methods:

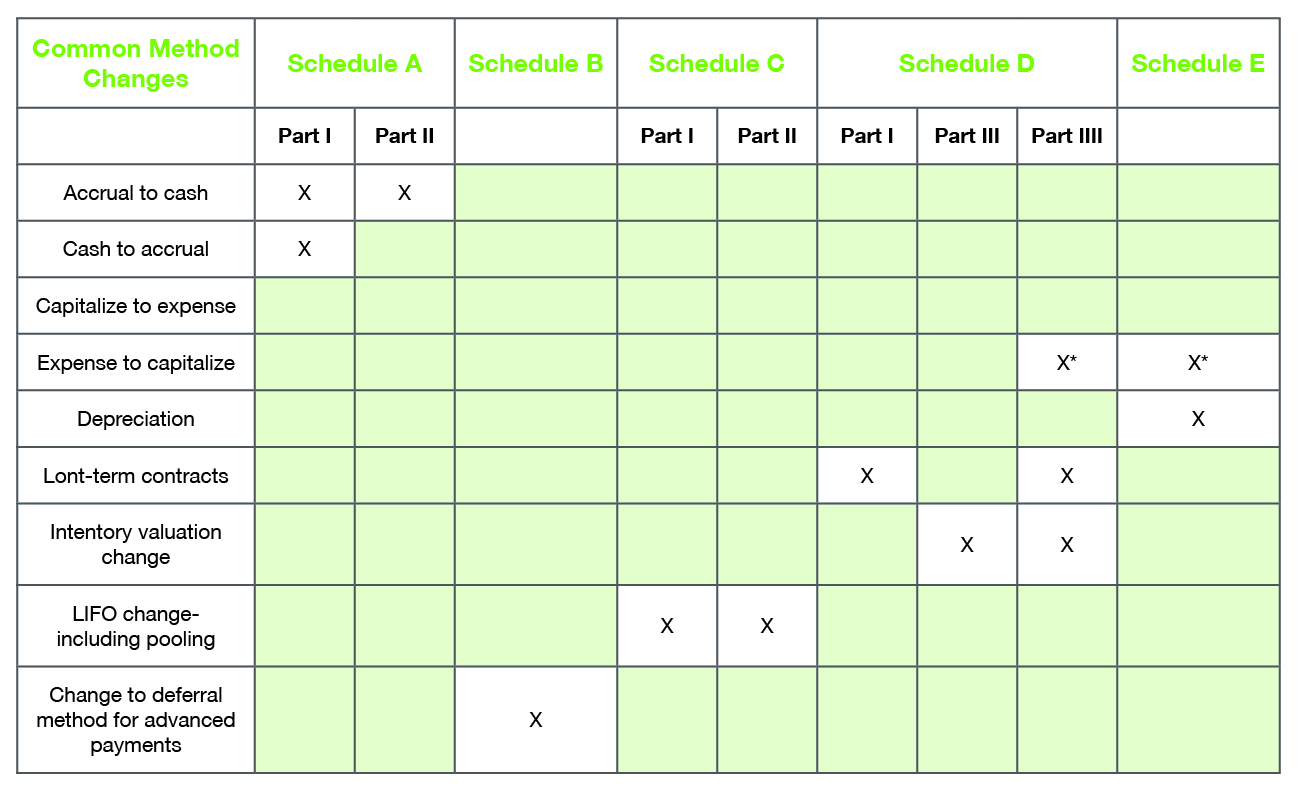

The following tables are from the Form 3115 instructions and highlight the filing needs for each procedure and most common changes in accounting methods.

For a more in-depth guide on completing the change of accounting method, including detailed examples, please see NATP’s white paper on this topic.