The guidance most practitioners were waiting on has been released. The Consolidated Appropriations Act, 2021 (CAA, 2021), passed by Congress on Dec. 27, 2020, states that otherwise deductible expenses paid for by a recipient of a Paycheck Protection Program (PPP) loan continue to be deductible even if the PPP loan is forgiven in accordance with the statute.

The deductibility of expenses also applies to PPP loans that were received under the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The CAA, 2021, reverses IRS guidance issued in May 2020 that stated PPP loan forgiveness would be treated as tax-exempt income and any approved business expenses paid with PPP loan monies would not be allowed. Thanks to Congress, the expenses are now allowed as a business tax deduction.

Shortly after the passage of CAA, 2021, the Treasury Department and the IRS issued guidance allowing deductions for the payments of eligible expenses when such payments would result (or be expected to result) in the forgiveness of a loan (covered loan) under the PPP. Revenue Ruling 2021-2 says no deduction is denied, no tax attribute is reduced, and no basis increase is denied by reason of the exclusion from gross income of the forgiveness of an eligible recipient’s covered loan. The change applies for tax years ending after March 27, 2020.

As a practitioner when you read the above, many questions come to mind. NATP’s researchers have been receiving many questions about how the forgiven loan is accounted for on the books and tax return.

The example below is a hypothetical based on how a client may present their books to you. We are not discussing financials (books) that are guided by the Financial Accounting Standards Board (FASB), which generally use accepted accounting principles (GAAP). The example is based on self-prepared financials used for tax preparation purposes.

There is no direct guidance from the IRS, and the below is speculative based on the guidance currently available.

Example: Coffee House, Inc. (Coffee House), an S corporation, obtained a $75,000 PPP loan and incurred $85,000 of eligible costs. Incurred cost are:

- Payroll-related ($54,000)

* $7,000 health insurance * $47,000 wages (represented as payroll expenses on profit and loss) - Non-payroll related ($31,000)

* $20,000 rent * $11,000 utilities

Coffee House reasonably expects forgiveness of the PPP loan, but has not received notification of forgiveness prior to filing the corporate return. Coffee House applies for forgiveness using the entire $85,000 of eligible expenses. The corporation’s shareholder presents self-prepared financials and wants you, the practitioner, to prepare a S corporation tax return. The financials are prepared using QuickBooks and the client has provided you access to the file.

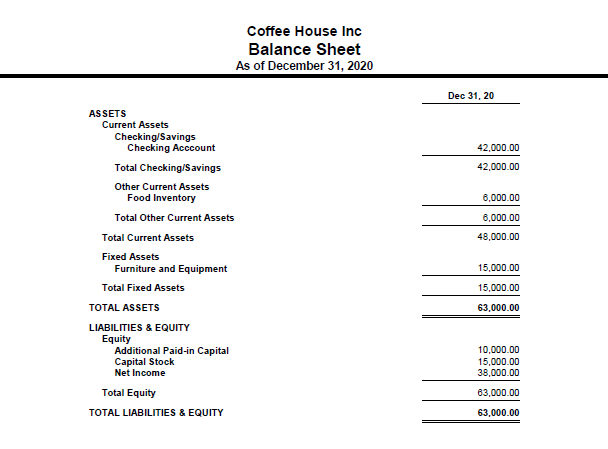

Self-prepared financials

This is a hypothetical and therefore not all items are reflected on the financials.

Reagan, the sole shareholder explains to you that 2020 was a tough year and after her initial stock purchase, she contributed $10,000 of additional money (to fund equipment purchases and inventory) in addition to the $75,000 PPP loan the business received. The business incurred a loss of $37,000, as reflected on the profit and loss statement.

When looking at the financials for clients who obtained PPP loans, practitioners will need to:

- Ask probing questions about the loan and how the proceeds were used. This will entail printing out and reviewing the appropriate reports.

- Make adjusting journal entries to clean up the financials, if appropriate

- Reagan provided clean financials and the above could be a good guide as to how the financials could look

- Prepare the tax return

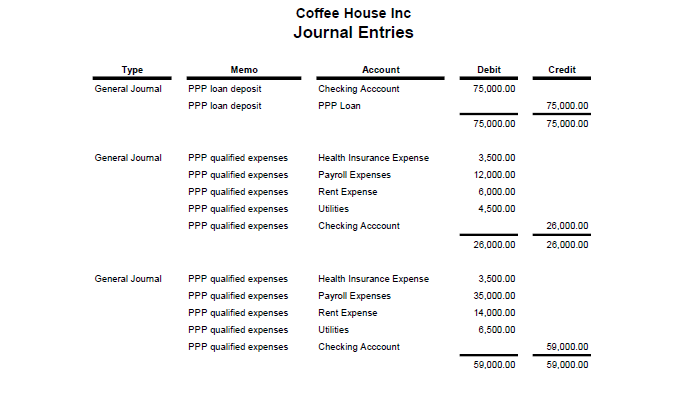

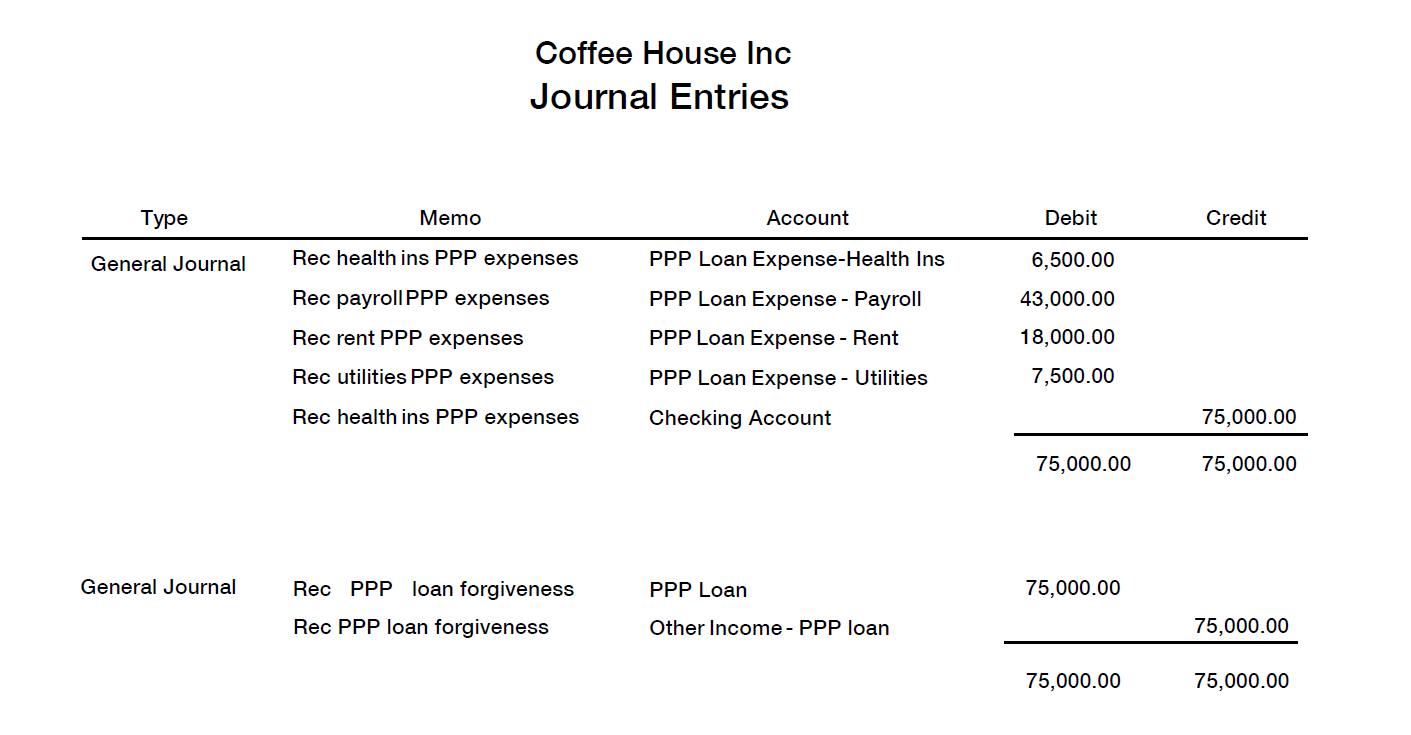

Client journal entries

As a practitioner, you reviewed the company’s journal entries (specific to PPP loan and expenses) and determined the entries were appropriate. The client’s journal entries, in this example, reflect qualified expenses. You also confirmed Coffee House used the proceeds to pay eligible expenses. If necessary, you could drill further into the QuickBooks file to and see the dates each transaction occurred.

Based on Coffee House’s financials, we see the PPP loan was recorded as a balance sheet item and is still reflected as such.

Under §61(a)(11), cancellation of debt (COD) income results when there is a reduction or cancellation of indebtedness. An identifiable event determines when a debt has been reduced or cancelled. An identifiable event includes events or circumstances that eliminate the likelihood that a debt will be paid. Businesses that receive PPP loans can apply for forgiveness of the PPP loan once they use the proceeds to pay eligible expenses. The $75,000 PPP loan forgiveness would be included in book income in 2020, as there is likelihood the debt will be forgiven. The matching principle in accounting requires a business recognize revenue and the related expense in the same accounting period. Thus, for book purposes, it seems appropriate 2020 would be the year the income on the PPP loan forgiveness would be recognized, even if not forgiven. As discussed above, the $75,000 will be excluded from taxable income.

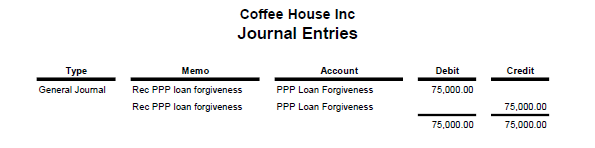

Practitioner journal entry

The practitioner would be making a year- end journal entry as follows:

The debit is to the PPP loan forgiveness (balance sheet) and the credit is Other Income: PPP Loan Forgiveness (Income Statement). The final book financials will reflect additional income of $75,000. The book financials are now showing a profit of $38,000 (($37,000) + $75,000 = $38,000).

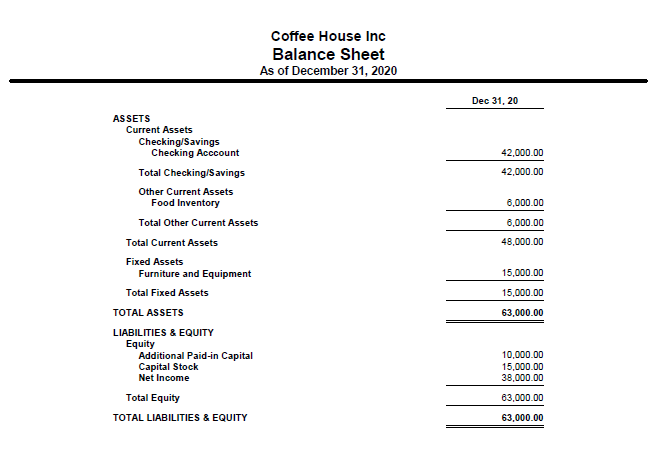

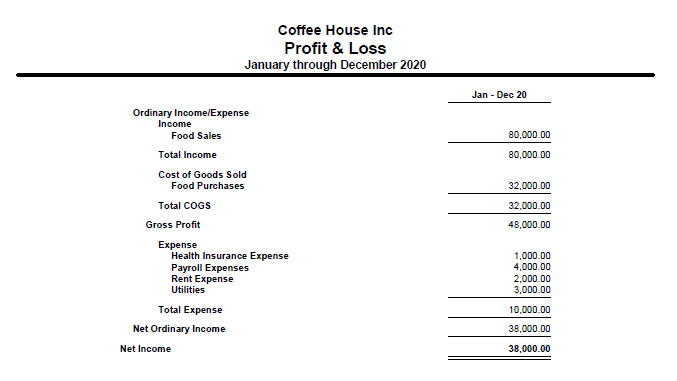

Final financials

It’s important to remember, book financials are client dependent. Each client will keep their books and records as they see fit and in a way that works for their business and serves their unique needs. An alternative reporting method is below. There are other possible presentations as well. We highlighted only two. After reconciliations are done, no matter the presentation, the net income number will be the same.

In the following financials, we see the same set of numbers, but a little different presentation from the client. In this scenario, the client offset the qualified expenses, up to the loan as a balance sheet item. The income statement currently reflects expenses paid with non-PPP funds.

Alternative client book presentation

In this example, Coffee House included the $75,000 in qualified expenses as an offset to the $75,000 PPP loan on the balance sheet. The profit and loss shows income of $38,000, which as we know is not correct as the business is entitled to deduct the $75,000 in expenses.

You may see this presentation as prior IRS guidance indicated qualified expenses paid with PPP funds would be non-deductible for tax purposes. For the sake of space, we are not providing the client journal entries; you would, however, do a review of the QuickBooks file as discussed above.

Practitioner financials

Practitioner journal entries

The above journal entries remove the PPP loan and expenses from the balance sheet to the income statement. Per your discussion with the client, the client wanted to keep expenses paid with PPP funds separate. There are many reasons for this including for comparison purposes, filling out the PPP forgiveness application and bank requirements, to name a couple.

The resulting book net income will be the same and the tax return income (loss) would be the same no matter how the client presents the book financials.

Tax return

The tax return will be prepared as usual. The PPP loan forgiveness will likely be a reconciling item on Schedule M-1, Reconciliation of Income (Loss) per Books With Income (Loss) per return, and on Schedule M-2, Analysis of Accumulated Adjustments Account, Shareholders’ Undistributed Taxable Income Previously Taxed, Accumulated Earnings and Profits, and Other Adjustments Account.

S corporations report changes in the Accumulated Adjustments Account (AAA) on Schedule M-2 of Form 1120-S. Schedule M-2 contains a column labeled Other Adjustments Account (OAA). The OAA includes items that affect basis but not the AAA, such as tax-exempt income. Distributions are made from the OAA after Accumulated Earnings and Profits (AEP) and the AAA are depleted to zero. Distributions from the OAA are generally tax-free.

Schedule M-1 and M-2 would be prepared as follows:

Schedule M-1 and M-2

Statement 2

Practitioner discretion should be used when selecting the language to be used to reflect the loan forgiveness.

Schedule L

Retained earnings reconciliation

Book liabilities and equity

As shown, Schedule L and Retained Earnings reconcile to the book financials. The retained earnings balances are based on book transactions and will generally not be the same as AAA or OAA, which are based on tax return amounts. It is a good idea to reconcile these amounts and perhaps keep a spreadsheet so you know what is causing these differences. These little extra services practitioners provide can go a long way in providing value and differentiating yourself from other preparers.

Basis

To deduct losses, a shareholder needs to have basis in the business. Losses in excess of basis are not allowed but are suspended and carried forward. Under §1367(a), S corporation shareholders are allowed to increase basis by tax-exempt income. As discussed above, the CAA, 2021, states “no deduction is denied, no tax attribute is reduced, and no basis increase is denied by reason of the exclusion from gross income of the forgiveness of an eligible recipient’s covered loan.” The question then becomes when is basis increased – in the year the loan is included in income or in the year the loan is forgiven? Under §61(a)(11), cancellation of debt income is recognized when debt is forgiven. In our example, if debt forgiveness won’t happen until 2021, there would be no basis increase until 2021, when the debt is forgiven. Until we receive further guidance from the IRS, this position would seem to be logical based on code.

In addition to PPP loans, businesses have been receiving money from other sources:

- State and local business grant

- Federal grant (non- PPP)

- EIDL Grant

- EIDL Loan

Grants will be taxable for federal purposes; whereas the EIDL grant or loan will not be taxable for federal purposes. Expenses paid with monies obtained from these programs will be allowed.

Lastly, the SBA recently released a procedural notice which addresses PPP loans made in excess of amounts allowed; in short, those loans will need to be repaid. For additional information refer to the SBA Procedural Notice.

Information included in this article is accurate as of the publish date. This post is not reflective of tax law changes or IRS guidance that may have occurred after the date of publishing.