With the IRS resuming its campus collection operations, it is more important than ever for you to be able to help clients who owe back taxes or have a balance due with their 2023 tax return. More and more taxpayers now owe the IRS back taxes and an increasing number of taxpayers are filing with a balance due.

The data

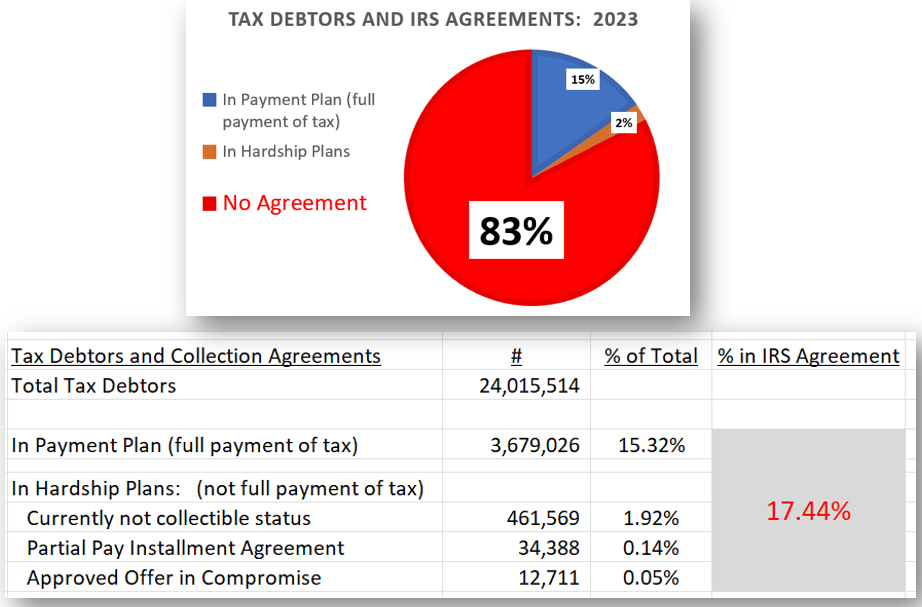

After over four years of pandemic-affected operations, the IRS now has over 24 million taxpayers who owe back taxes. If that number is not startling enough, the number of taxpayers who are not in a collection agreement on their back balances is astonishing. Almost 83% are not in good standing – that is, they are not in any agreement such as an extension to pay, a payment plan, or a hardship agreement such as not collectible status or an offer in compromise. As a result, they face potential IRS collection enforcement through tax liens, levies and passport restrictions.

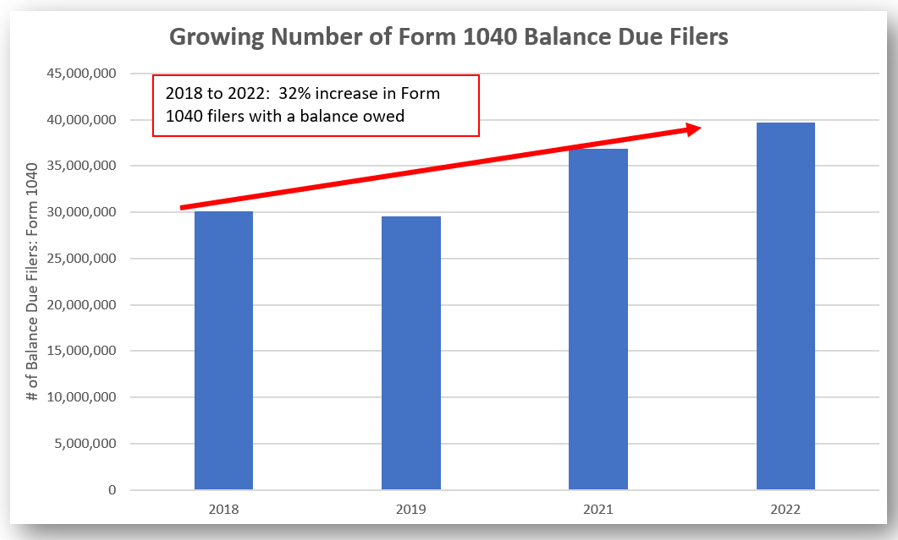

The increase in tax debtors is not likely to end soon. The number of balance-due 1040 filers has been growing steadily over the past few years. Form W-4 confusion, the growing gig economy workforce and the end of stimulus funds have all provided the perfect storm for many surprised balance-due filers.

The trend does not appear to be ending with the 2023 tax returns, either. In fact, as of March 15, 2024, the number of 2023 tax year Form 1040 balance-due filers is already up 6.9% from last year.

How you can help

To stop the balance-due trend, tax professionals will need to work with their clients to correct payments made to the IRS throughout the year. Correcting withholding and estimated tax obligations can be a year-round task. The Form W-4 has been described as a “mini-tax return” that requires professionals to fine-tune withholding calculations.

When clients owe, it is important to get them into good standing with the IRS. The options to get compliant are payment plans, extensions to pay and the hardship agreements. 88% of all taxpayers select payment plans, most of which are simple to set up online if you owe the IRS less than $50,000. The IRS’s Online Payment Agreement application allows for payment plans up to 72 months for those who owe less than $50,000 (called a “streamlined installment agreement”) and for 180-day extensions to pay (IRS calls extensions to pay a “short-term payment agreement”) for those who owe up to $100,000.

There is also another payment agreement option that started in February 2020, just before the onset of the pandemic: the new full-pay, non-streamlined installment agreement (FP NSIA). The FP NSIA allows a taxpayer to enter into a payment plan when they owe up to $250,000. The IRS allows these taxpayers to pay their balances in monthly payments until the collection statute expires (10 years from the date of assessment). These plans are simple to set up with the IRS and require only a phone call.

If your client is in financial hardship and cannot pay their tax bill, you can consider other ‘ability to pay’ hardship options such as partial pay installment agreements, not collectible status or an offer in compromise. These options require proof of your client’s ability to pay through assets and monthly payments.

It is important to note that tax liens can occur even when you are in an agreement with the IRS. Only a timely extension to pay or streamlined installment agreement can avoid a Notice of Federal Tax Lien. If a taxpayer owes more than $10,000 and enters into a FP NSIA or any of the hardship agreements, the IRS will generally file a tax lien to protect their collection interests.

As IRS campus collection restarts and the IRS enters into “enforcement” mode this summer, it is important to get your clients into good standing with the IRS by executing one of the collection options to make a full payment. Once the client is in an agreement with the IRS, they can avoid dreaded IRS enforcement actions.

Information included in this article is accurate as of the publish date. This post is not reflective of tax law changes or IRS guidance that may have occurred after the date of publishing.