Some drivers looking to purchase an electric vehicle in 2023 can still take advantage of a federal tax credit when it comes time to prepare their 2023 returns, but buyers will need to satisfy more conditions than in previous years.

The Inflation Reduction Act of 2022 expanded and modified the current electric vehicle tax credit’s stipulations to include more makes and models, as well as used electric vehicles. However, it also limited the tax credit to vehicles under a specified retail price, added North American sourcing requirements, and limited the credit to taxpayers earning less than a specified amount. Some electric vehicles purchased and delivered in 2022 were also impacted by this legislation.

The clean vehicle credit, which replaces the qualified plug-in electric drive motor vehicle credit, can be claimed for the purchase of a qualified vehicle beginning in 2023 through 2032. The maximum credit is $7,500 for buyers of new all-electric vehicles and hybrid plug-ins. To qualify for the credit, the vehicle must be sold after Aug. 16, 2022, the final assembly of the vehicle must be in North America and the manufacturer must meet the battery and critical mineral components requirement. The per-manufacturer cap is eliminated. Before this new legislation, the credit began to phase out for a manufacturer when that manufacturer sold 200,000 qualified vehicles.

For taxpayers who entered into binding contracts between Jan. 1, 2022, and Aug. 16, 2022, a transition rule applies. If a taxpayer purchased a vehicle before Aug. 16, 2022, the qualified plug-in electric drive motor vehicle (“old”) rules applied.

For taxpayers who had written binding contracts in place before Aug. 16, 2022, but took possession after Aug. 16, 2022, the old rules also apply, and the new final assembly rules do not apply. For those who purchased and took possession of the vehicle on or after Aug. 16, 2022, but before Jan. 1, 2023, the old rules applied, including manufacturing caps, but the new final assembly rules also apply.

The legislation also includes a new credit for previously owned clean vehicles. To claim this credit, a qualified buyer must purchase and place in service a previously owned clean vehicle after 2022. The credit amount is the lower of $4,000 or 30% of the cost of the vehicle.

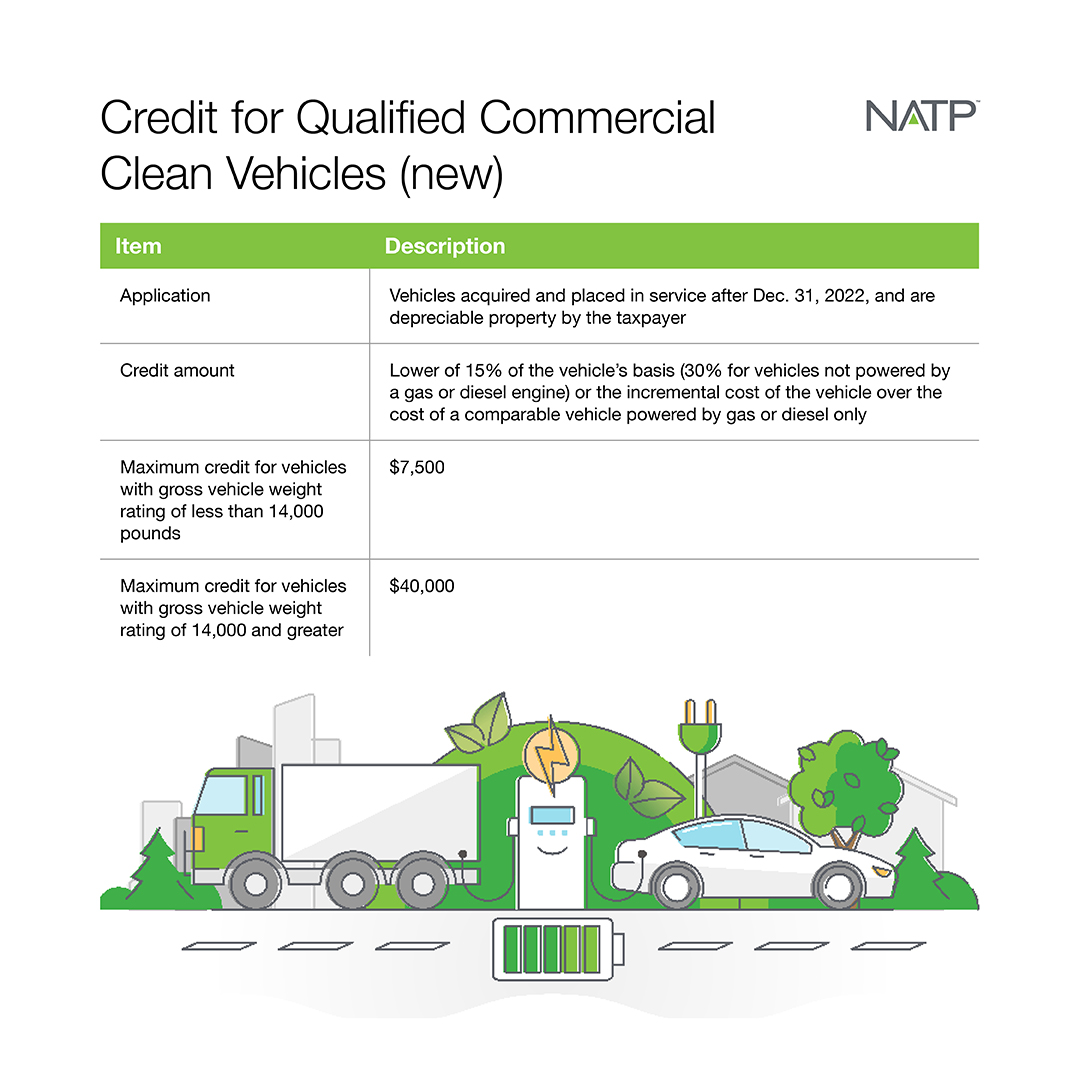

The act also added a new credit for qualified commercial clean vehicles. This credit is for qualifying commercial use clean vehicles acquired after Dec. 31, 2022.

There are several details that have yet to be announced by the IRS, including when and how the tax credit will be given to buyers, but more information will likely be made available as 2023 progresses.

Information included in this article is accurate as of the publish date. This post is not reflective of tax law changes or IRS guidance that may have occurred after the date of publishing.