Income and losses from any rental activity is generally considered passive. One exception to this rule applies to real estate professionals. Taxpayers involved in real estate rental must overcome two obstacles to avoid the classification of an activity as passive.

First, taxpayers must establish that they qualify as real estate professionals to avoid the general rule that all rental activity is passive.

Second, if the taxpayer qualifies as a real estate professional, the taxpayer must show that they materially participated in the rental real estate activity. If the taxpayer does not meet both of these requirements, any losses from the rental activity will be passive and subject to the passive activity loss limitations.

Real estate professionals may treat otherwise passive rental real estate activities as nonpassive if they materially participate in the rental activity. If a taxpayer is a real estate professional, losses from their real estate activities can be used to offset wages, interest and other nonpassive income.

To qualify as a real estate professional, the taxpayer must meet the following requirements:

- Personal services test. More than 50% of the taxpayer’s personal services in all businesses must be in real property trades or businesses in which the taxpayer or taxpayer’s spouse materially participates.

- The 750-hour test. The taxpayer must spend more than 750 hours a year in real property trades or businesses in which the taxpayer or the taxpayer’s spouse materially participates.

- Time spent managing a short-term rental property will not qualify for this test. Short-term rental property is property averaging a rental period of seven days or less. This type of property is trade or business property, not real property trade or business property.

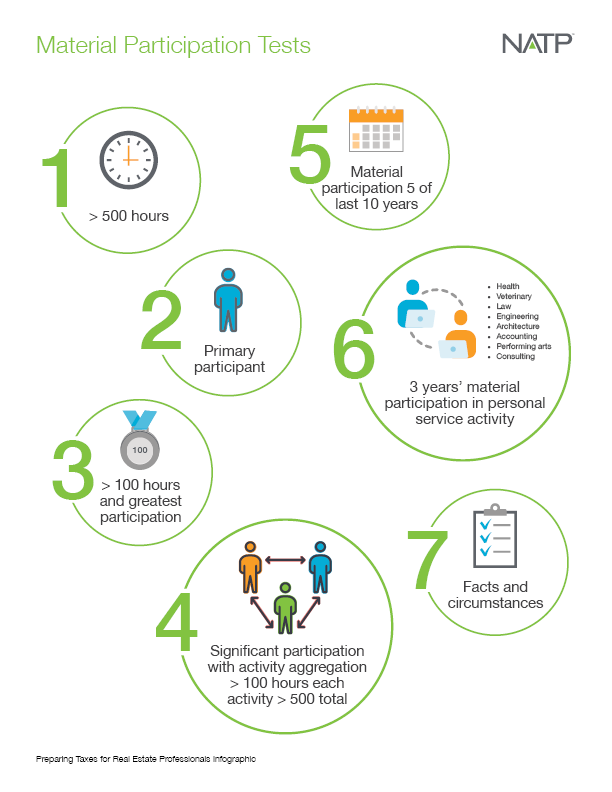

Both of these requirements require material participation. A taxpayer materially participates in an activity if they meet one of seven tests.

As previously stated, a taxpayer (individual) is required to pass at least one of the material participation tests to be considered a material participant. If they do not, passive activity rules apply, which means the taxpayer’s participation in the rental real estate activity is not regular, continuous and substantial, and it limits their ability to deduct passive losses on their return.

The test includes:

- The individual participates in the activity for more than 500 hours during the tax year.

- The individual’s participation in the activity for the tax year consitutes substantially all the participation in the activity of all individuals (including nonowners) for the year.

- The individual participates in the activity for more than 100 hours during the tax year and their participation is not less than the participation of anyone else (including non-owners) during the year.

- The activity is a significant participation activity for the taxable year, and the individual’s aggregate participation in all significant participation activities during such year exceeds 500 hours.

- The individual participated in the activity for any five of the immediately preceeding 10 taxable years (five taxable years do not need to be consecutive).

- The activity is a personal service activity and the individual materially participated in the activity for any three taxable years (whether or not consecutive) preceding the taxable year.

- Based on all facts and circumstances, the individual participates in the activity on a regular, continuous and substantial basis.

The above is meant to provide general guidance for tax professionals when dealing with clients who may or may not meet the requirements to be a real estate professional. This is a complicated area with many nuances. NATP has a Preparing Taxes for Real Estate Professionals on-demand webinar for those who are interested in learning more.

We’ve also provided a reference diagram of key elements of the material participation tests.

Information included in this article is accurate as of the publish date. This post is not reflective of tax law changes or IRS guidance that may have occurred after the date of publishing.