Coronavirus-related distributions from an IRA or qualified plan

Form 8915-E and no early withdrawal penalty

Many taxpayers have been impacted by the coronavirus and as a result, may have had to take distributions from retirement plans during 2020. Many of these distributions were taken by taxpayers under the age of 59 ½.

New legislation allows qualified individuals to receive special tax treatment for coronavirus-related distributions, up to $100,000, made from eligible retirement plans between Jan. 1 and Dec. 30, 2020 (before Dec. 31, 2020).

A coronavirus-related distribution is not subject to the 10% additional tax, generally can be included in income over three years and could potentially be recontributed to an eligible retirement plan within three years.

This article focuses on the newly created Form 8915-E, Qualified 2020 Disaster Retirement Plan Distributions and Repayments (Use for Coronavirus-Related Distributions) and the application to the 2020 tax return when coronavirus related distributions are received from a 401(k) plan. Before we look at Form 8915-E, an overview of the Coronavirus Aid, Relief, and Economic (CARES) Act provisions regarding coronavirus-related distributions and some key terms will be discussed.

CARES Act retirement plan relief

As many of you already know, under §72(t) a distribution from a qualified retirement plan (including traditional, Roth, SEP and SIMPLE IRAs) is subject to a 10% additional tax (25% for certain SIMPLE IRAs) if received before age 59 ½ unless the distribution meets an exception. The CARES Act states that the additional 10% tax does not apply to any coronavirus-related distribution, up to $100,000 [Act Sect. 2202(a)(1)].

Furthermore, unless the taxpayer elects not to, the distribution will be included in income ratably over a three-year tax period beginning with the year of distribution [Act Sec. 2202(a)(5)(B)]. Form 8915-E will be used by qualified individuals to report any recontribution made during the taxable year and to determine the amount of the coronavirus-related distribution includible in income for the taxable year [IRS Notice 2020-50].

The coronavirus-related distribution should not be confused with the CARES Act provision that increase the maximum plan loan amounts. The loan provisions are beyond the scope of this article and are a separate provision.

Coronavirus-related distribution

A coronavirus-related distribution is a distribution from an eligible retirement plan made:

- On or after Jan. 1, 2020, and before December 31, 2020, and

- To a qualified individual

Qualified individual

A qualified individual is someone:

- Who is diagnosed with the virus SARS-CoV-2 or with COVID-19 by a test approved by the CDC

- Whose spouse or §152 dependent is diagnosed with the virus or disease by such test, or

- Who experiences adverse financial consequences as a result of the coronavirus

Adverse financial consequences

Adverse financial consequences can include any of the following:

- Being quarantined

- Being furloughed, laid off or having hours reduced due to the virus or disease

- Being unable to work due to lack of childcare due to the virus or disease

- Closing or reducing hours of a business owned or operated by the individual due to the virus or disease, or

- Other factors as determined by the secretary of the treasury

Eligible retirement plan

An eligible retirement plan includes the following:

- IRAs or annuities

- Qualified employer-sponsored retirement plans

- §403(a) annuity plans

- §403(b) tax-sheltered annuity plans, and

- §457(b) plans

Recontribution

An individual who receives a coronavirus-related distribution may recontribute the amount of those distributions to an eligible retirement plan within three years of receiving the distribution.

The recontributed amounts are treated as if they were eligible rollover distributions that were transferred in a direct trustee-to-trustee transfer within 60 days. This means the original distribution is not subject to tax and the contributions are not counted against the annual limits. The recontribution must be made to an eligible retirement plan; the receiving plan does not have to be the same plan from which the funds were withdrawn.

Recontributed dollars are not taxed. Because individuals have up to three years to recontribute qualified distributions, prior year returns may need to be amended. If a qualified individual recontributes more than the amount that is otherwise includable in income for a particular tax year, the excess amounts may be carried forward to subsequent tax years or carried back to previous tax years. The carryback would require the filing of an amended return(s).

Recontribution examples are provided later in the article.

Include in income over three years

Unless the taxpayer elects not to, income attributable to the early withdrawal is subject to tax over a three-year period that begins in the year of the distribution. Notice 2020-50 states that if an individual elects out of the three-year inclusion period, the entire amount of the taxable portion of the coronavirus-related distribution is included in income in the year of the distribution. The inclusion year would be the 2020 tax year.

This election cannot be changed after the timely filing of the qualified individual’s tax returns, including extensions, for the year of the distribution. Also, if the taxpayer receives more than one distribution during the year, all the distributions for that year must be treated the same way.

Example for inclusion in income over three years are provided later in the article.

Plan reporting

The payment of a coronavirus-related distribution to a qualified individual must be reported by the eligible retirement plan on Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Form 1099-R reporting is required even if the qualified individual repays the coronavirus-related distribution in the same year.

Notice 2020-50, states an IRA custodian/trustee must report all coronavirus-related distributions on Form 1099-R, based on the age of the IRA owner. For example, if the distribution was taken before age 59 ½, Code 1 would be used if from a traditional IRA or Code J if from a Roth IRA. Notice 2020-50 states Code 2, early distribution-exception applies, is acceptable.

Taxpayer reporting

Qualified individuals may designate any eligible distribution as a coronavirus-related distribution as along as the total designated as such is not more than $100,000. This is true regardless of whether the eligible retirement plan treats the distribution as a coronavirus-related distribution.

For 2020, a coronavirus-related distribution needs to be reported on the individual tax return. The taxable portion of the distribution is included ratably over a three-year period (2020, 2021 and 2022) unless the taxpayer elects to include the entire amount in income in 2020.

Regardless of if a federal income tax return is or isn’t required to be filed, the taxpayer would use Form 8915-E to report any repayment of a coronavirus-related distribution and to determine the amount of any coronavirus-related distribution includible in income for a year. If the taxpayer does not have a filing requirement, Form 8915-E would be filed by itself.

Form 5329, Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts, will need to be attached to the tax return to report the inapplicability of the 10% additional tax if the early distribution was a coronavirus related distribution and Form 1099-R lists Code 1. Per Form 5329 instructions, Code 12 (other) is the exception number to be used on Line 2. Depending on the taxpayer’s situation, Form 8606, Nondeductible IRAs, may need to be filed.

As a practitioner, it is important to be aware that taxpayers may receive a Form 1099-R with the incorrect code in Box 7. Remember, a qualified individual may treat a distribution that meets the requirements to be a coronavirus-related distribution as such a distribution, regardless of how the eligible retirement plan treats the distribution.

As practitioners, we will need to do our due diligence and ask probing questions as some clients will be receiving Form 1099-R with a code of 1, early distribution, no known exception (in most cases, under age 59 ½) when the correct code is 2, early distribution, exception applies (under age 59 ½). Spend time asking questions of the clients to ensure proper reporting of the distribution on the tax return.

Form 8915-E

Form 8915-E is a new form is used to report coronavirus-related distributions where the taxpayer, taxpayer’s spouse, dependent, or a member of the taxpayer’s household was impacted by the coronavirus and withdrawals were made from an eligible retirement plan before Dec. 31, 2020. At the time of this writing Form 8915-E and the instructions were in draft form.

We will start by looking at a couple of examples where there is no recontribution of coronavirus-related distributions. These situations will most likely be the easier ones you encounter in practice.

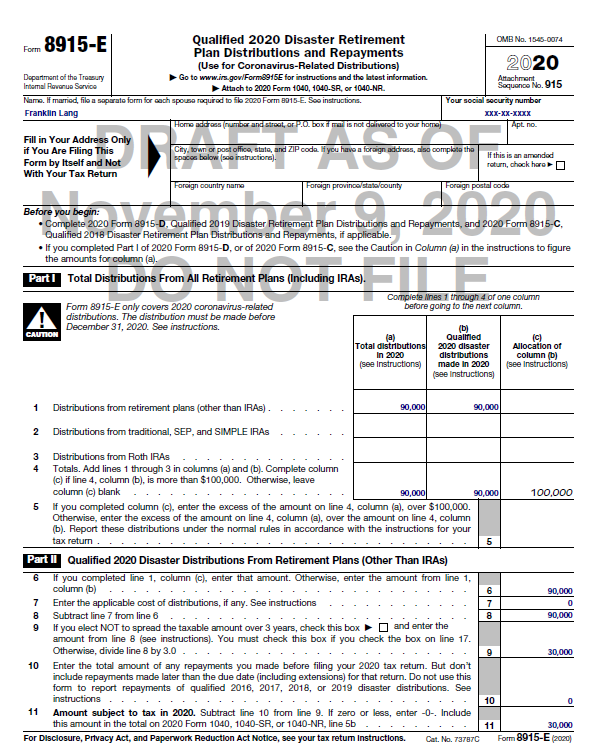

Example – three-year ratable income inclusion

Franklin, a qualified individual, receives a $90,000 coronavirus-related distribution from his 401(k) plan on Nov. 1, 2020. This was Franklin’s only distribution in 2020. He elects to use the three-year ratable income inclusion method for the distribution. Franklin will be timely filing his 2020 income tax return. The $90,000 distribution was reported on Form 1099-R, Box 1, and Franklin has zero basis in the distribution. Form 8915-E for 2020 would look at follows:

Line 11 reports the $30,000 ($90,000/3) Franklin is required to include in income. Franklin will be reporting $30,000 in income in tax years 2020, 2021 and 2022.

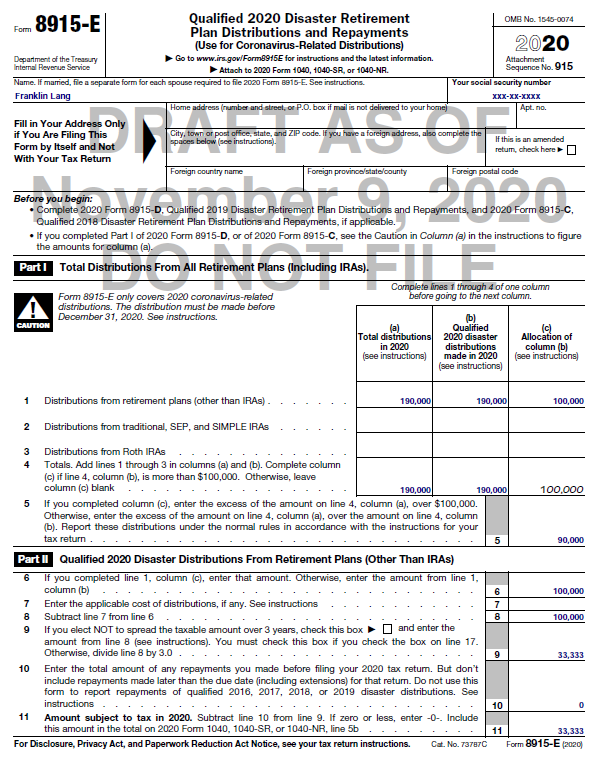

Example – Elect not to spread over three years

Assuming the facts are the same as the previous example, except Franklin decides he does not want to spread the taxable amount over three years. Part I of the Form 8915-E is unchanged. Part II of the form changes and looks as follows:

As Line 11 of the form indicates, the entire $90,000 is includable in income. Also, the box on Line 9 needs to be checked because Franklin is electing not to spread the taxable amount over three years.

Example – Distribution greater than $100,000

Franklin, a qualified individual, receives a $190,000 coronavirus -related distribution from his 401(k) plan on Nov. 1, 2020. This was Franklin’s only distribution in 2020. He elects to use the three-year ratable income inclusion method for the distribution. Franklin will timely file his 2020 income tax return. The $190,000 distribution was reported on Form 1099-R, Box 1, and Franklin has zero basis in the distribution. Form 8915-E for 2020 would look at follows:

Because Franklin’s distribution was greater than $100,000, Column (c) would need to be filed out and an allocation of the amount in Column (b) would need to be made. The allocation is required as the distribution cannot exceed the $100,000 limit.

The distribution in excess of $100,000 ($90,000 as reported on Line 5) will be reported on Franklin’s tax return following the normal distribution rules. Franklin is reporting $33,333 (Line 11) in income in 2020, 2021 and 2022 (rounding of $1 is immaterial).

It should be noted that if there are distributions from more than one type of retirement plan and the total distribution exceeds $100,000, the taxpayer may allocate the $100,000 limit among the plans using any reasonable method.

This discussion is beyond the scope of the material presented in this article.

If the taxpayer takes a distribution and does not recontribute any of the funds, the Form 8915-E and income reporting is pretty straightforward. Complexity enters the equation when the taxpayer recontributes the coronavirus-related distribution.

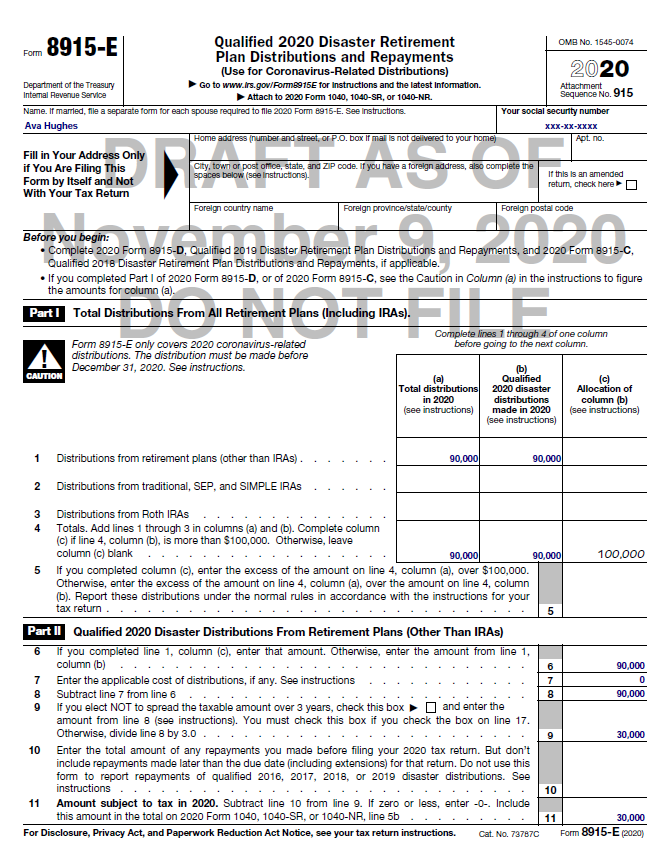

The following examples illustrate how a qualified individual reports recontributions of coronavirus-related distributions. We can assume a Form 1099-R was received reporting the distribution, Ava had zero basis and Form 5329 filing requirements will be ignored.

Example

Ava, who is a qualified individual, receives $75,000 from a 401(k) plan on Dec. 1, 2020, and treats the distribution as a coronavirus-related distribution. She elects to use the three-year ratable income inclusion method for the distribution.

Ava makes one recontribution of $25,000 to the 401(k) plan on April 10, 2022. The income tax return for the 2021 tax year is filed on April 15, 2022. If Ava had made no recontributions, she would include $25,000 in income in each of her tax returns for the 2020, 2021 and 2022 tax years. Because Ava included the $25,000 recontribution for the 2021 tax year, she includes in taxable income $25,000 for the 2020 and the 2022 tax years, and $0 in 2021.

For 2020 and 2022, Ava completes Form 8915-E following the format of the above examples. A Form 8915-E would be completed for the 2021 tax year using the same format as above except a recontribution amount of $25,000 would be reported on Line 10 and Line 11 would be $0.

Example

Ava, who is a qualified individual, receives a distribution of $90,000 from her 401(k) plan on Nov. 15, 2020, and treats the distribution as a coronavirus-related distribution. The three-year ratable income inclusion method is elected for the distribution. Without any recontribution, Ava will include $30,000 in income for the 2020, 2021, and 2022 tax years. Ava recontributes $40,000 to her 401(k) plan on Nov. 10, 2021. Ava now has two options:

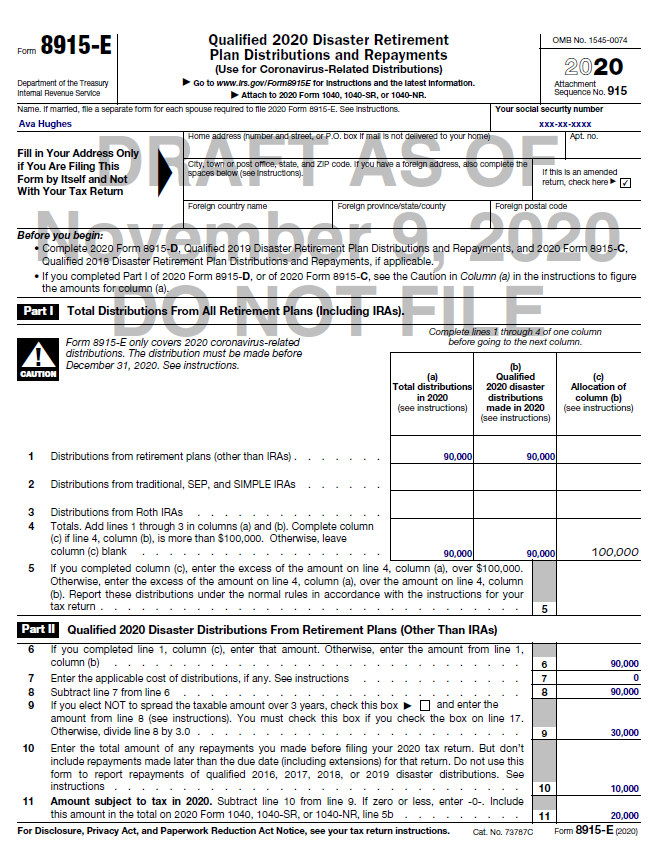

Option 1: Ava includes $0 in income for the 2021 tax year. She can choose to carry forward the remaining $10,000 in recontributions to the 2022 tax year. For the 2022 tax year she will include $20,000 in income. Ava’s 2020 tax year tax return will remain unchanged and $30,000 will still be included in income.

Option 2: Ava includes $0 in income for the 2021 tax year. She can choose to carry back the excess $10,000 in recontributions to the 2020 tax year. This results in Ava including $20,000 in income for the 2020 tax year and requires Ava to amend her 2020 tax return, including filing an amended Form 8915-E. Ava will include $30,000 in income for the 2022 tax year.

Ava’s original 2020 Form 8915-E would look at follows:

Ava’s 2020 amended Form 8915-E would look as follows:

Note, in the heading section of Form 8915-E, the amended box on the right below the apt. no. is checked.

The examples above reported distributions from 401(k)’s. If the distribution came from an IRA, the form would be filled out the same, except Part III would be used, instead of Part II to calculate the amount subject to tax in 2020. A blank Part III is included below:

Standalone filing

And as we stated above, if the taxpayer does not have a Form 1040 filing obligation, Form 8915-E can be filed by itself. If a taxpayer is married filing a joint return, each spouse would need to file separate Form 8915-E’s, if applicable.