Your business clients looking to expand their enterprise may have started, or are starting to look into their different options. As you, the tax professional, know, there are different types of business entities, and this is a decision that should not be taken lightly as there are potential tax implications and benefits of each type. There are generally five types of partnerships: domestic general partnership, domestic limited partnership, domestic limited liability company, domestic limited liability partnership and foreign partnership. There is also the option to form an S corporation, a C corporation, an LLC, etc.

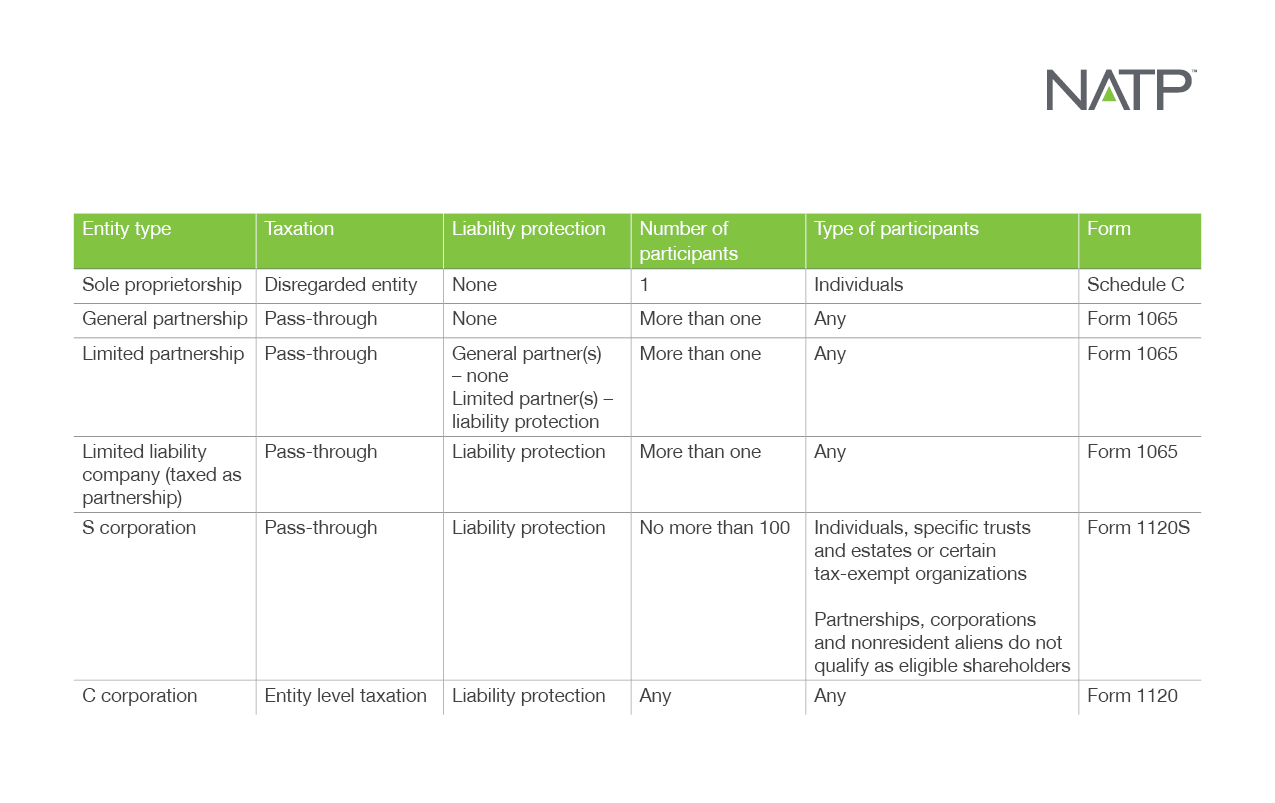

Partnership returns require a special expertise when it comes time to prepare, and Schedule B must be completed to identify the type of entity filing the partnership return. We’ve compiled a chart that can help you and your business clients when discussing the different business entity types and the tax implications of each.

Expanding your practice to serve business clients can be a great move to increase revenue and client base. NATP offers many on-demand courses that can help you get started, including Converting a Sole Proprietorship to a Partnership and Learning to Set Up a Partnership.

Information included in this article is accurate as of the publish date. This post is not reflective of tax law changes or IRS guidance that may have occurred after the date of publishing.