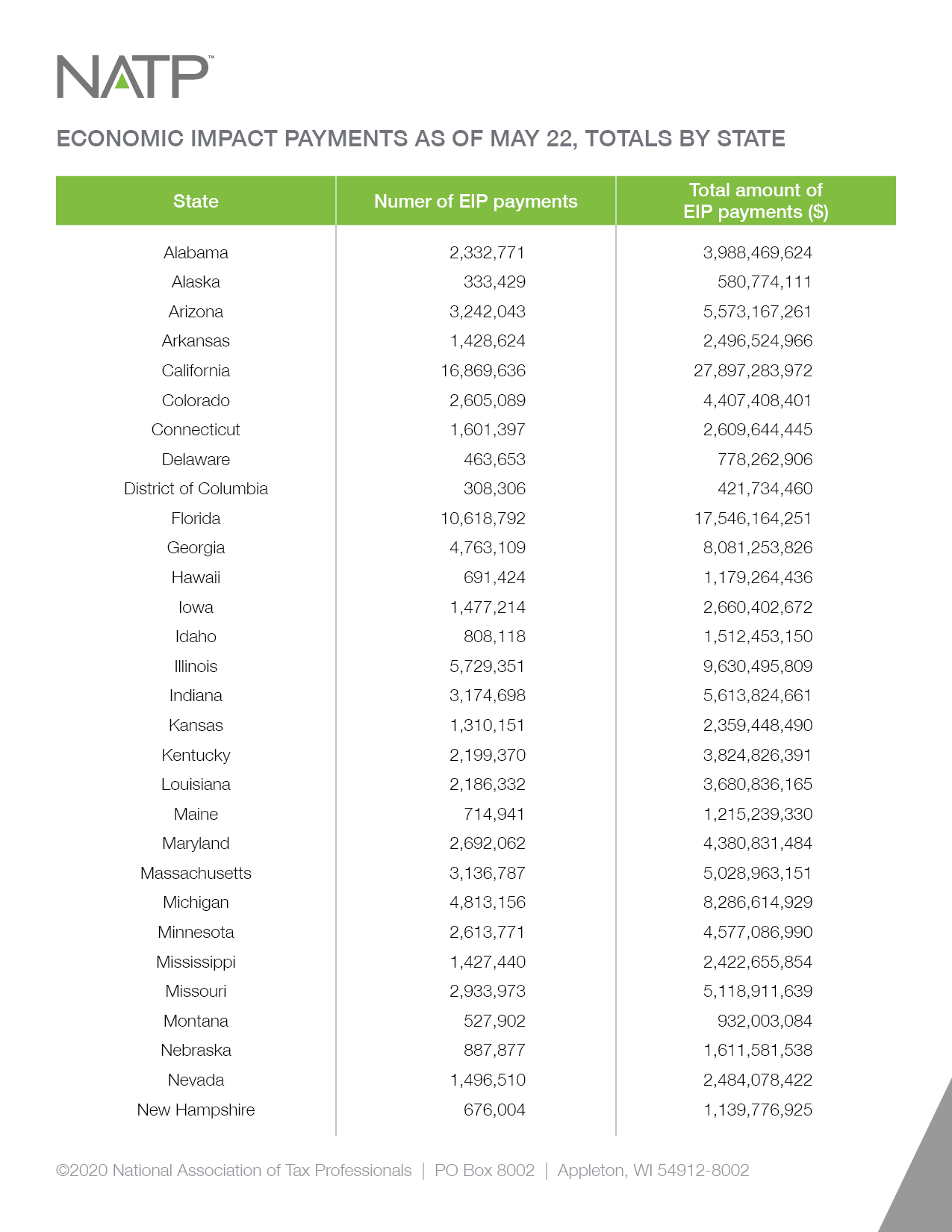

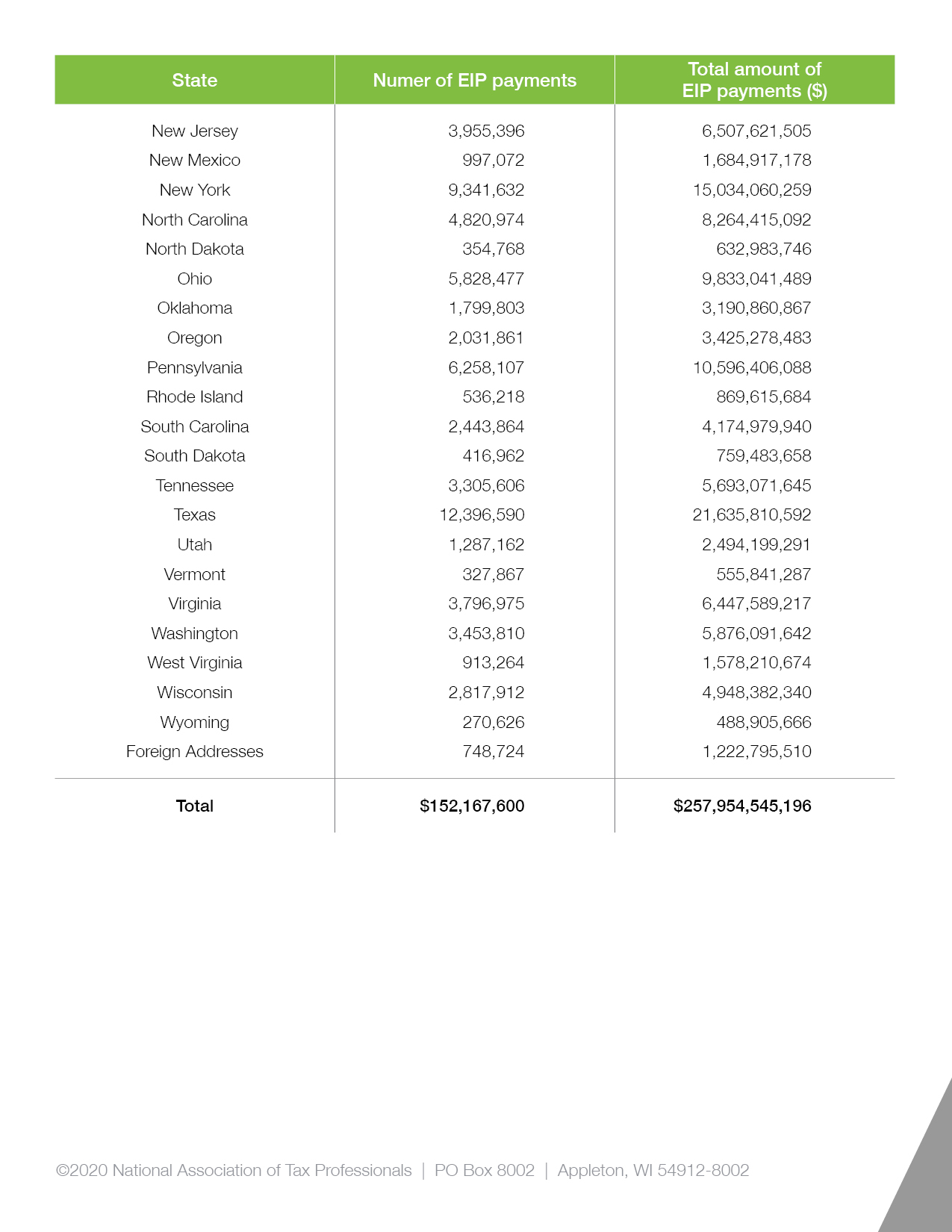

IRS’s Economic Impact Payment data as of May 2020

Approximately 130 million Americans received payments worth more than $200 billion in the Economic Impact Payment program’s first four weeks, according to the IRS.

“We are working hard to continue delivering these payments to Americans who need them,” said IRS Commissioner Chuck Rettig. “The vast majority of payments have been delivered in record time, and millions more are on the way every week. We encourage people to visit IRS.gov for the latest information, FAQs and updates on the payments.”

More than 150 million payments will be sent out, and millions of people who do not typically file a tax return are eligible to receive these payments. Payments are automatic for those who filed a tax return in 2018 or 2019, receive Social Security retirement, survivor or disability benefits (SSDI), Railroad Retirement benefits, as well as Supplemental Security Income (SSI) and Veterans Affairs beneficiaries who didn’t file a tax return in the last two years.

For those who don’t receive federal benefits and didn’t have a filing obligation in 2018 or 2019, the IRS encourages you to use its non-filer tool to quickly register for these payments, which will be distributed throughout the year.

Payment information updated as of May 22, 2020, is listed in the chart below.